While announcing quarterly results, Toyota today gave a glimpse into its mid-term plans. Essentially, they call for marginal growth. If executives of Volkswagen or GM would have been in the Bunkyo bunker conference room, they would by now be at Ginza hostess bars to celebrate their assured triumph over Toyota. Too much celebrating, and they will wake up with a headache and their money in the kimono folds of the Ginza hostesses.

Toyota’s net profit for the October through December period jumped to 525.4 billion yen, up 425.9 percent from the same period in the previous year. Sales had risen 23.8 percent, to 6.59 trillion yen. Of course the weaker yen had something to do with the leap in profits, but also American lawyers. Last year’s quarter “included the recording of settlement cost of the class action litigation,” as Toyota’s Managing Officer Takuo Sasaki told the assembled Fourth Estate. Last year, Toyota had to throw a billion bucks to class action wolves that hounded the company, despite the fact that it had been absolved from any unintended acceleration issues.

Nine months into the current fiscal, Toyota feels secure to expect 2.4 trillion yen ($24 billion) in annual operating profit, which, according to Reuters, could end up higher than its pre-Lehman crisis record of 2.27 trillion yen from six years ago.

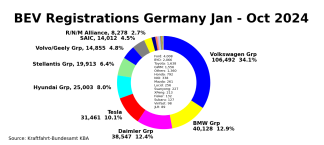

What will Toyota do with all the money it makes? This was on the minds of many reporters in the room, and Sasaki’s answer always amounted to “not much.” Volkswagen and GM, hot on the heels of Toyota in the quest of world domination, sometimes appear to launch more new factories than models. Toyota on the other hand announced last year that there won’t be new factories for at least three years. Today, it stood firmly by the building stop, declaring several times that “the policy remains unchanged.” If Volkswagen and GM can sell all the cars they plan to build, they will pass Toyota, if not this year, than next. Toyota does not seem to be concerned.

“It’s not that we build a plant first and then increase the market,” Sasaki lectured a reporter. “First, we have to secure the sales volume, and then, we have to catch up the supply to the demand.”

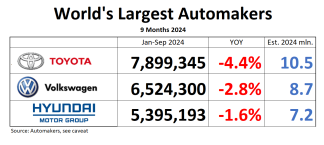

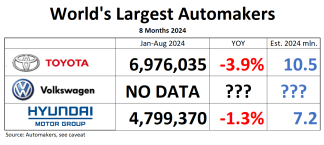

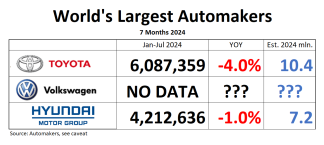

When a reporter mentioned that Toyota has capacity for a million units in China, whereas Volkswagen and GM are each building factories with space for 4 or 5 million units per year, Sasaki insisted that “if we run out of capacity, then we build new plants.” For the coming year. Toyota (ex. Daihatsu and Hino) plans for global sales of 9.28 million, and it has capacity for 9.8 million. That’s a miraculous 95 percent capacity utilization on a global level, and it would make many car execs very nervous, and screaming for bricks and mortar. Even with modern methods, capacities can’t easily be shifted around the globe. Sasaki looked relaxed and was confident that all that “surplus capacity can fully satisfy increases in demand.”

It looks like Toyota doesn’t share the optimism that a new boom is about to happen in the car business. Sasaki said his company expects that the U.S. continues its mild recovery, and that Europe may have bottomed out. Toyota also appears to be worried about a crash of the emerging markets, triggered by the tapering of economic stimulus by the U.S. Federal Reserve. In recent weeks, financial markets became jittery. “Investors remain nervy,” says Reuters, “especially around the so-called “Fragile Five” economies of Turkey, Brazil, India, Indonesia and South Africa,” all of them high growth targets of automakers. An emerging market collapse would not only impact heavily on an area where Toyota plans to sell more than half of its cars. It would also reverse the course of the yen. It already is reversing. End of the year, a dollar bought 105 yen, today, it buys 101.

In crisis times, the yen is seen as a safe currency. Sasaki reminded the room several times today that before the 2008 crisis, the yen was much cheaper. Indeed, the dollar bought 123 yen before the bottom fell out of the markets, and a dollar was worth only 75 yen at times.

So what will Toyota do with all the money it makes? “New plants aren’t everything,” Sasaki said today. “We also could build training centers.”

Did I mention headaches? Volkswagen and GM are much more exposed to China and other emerging markets than Toyota.