“We have to be very careful about the developments in Russia,” warned Toyota’s Managing Officer Takuo Sasaki today during the Q1 earnings conference in Tokyo. “There may be some sanctions imposed.”

Russia and the West are both ratcheting up pressure. The EU passed a basket of sanctions. The first Russian accounts are frozen. Russia stopped imports of American chicken and Bourbon, along with Polish apples. This is just the beginning of a tit-for-tat that is beginning to have real bite. Russia threatens to increase gas prices, and to terminate overfly rights for foreign airlines. A Russian magazine figures this could cost Lufthansa, British Airways and Air France four billion euro a year. Western carmakers are heavily invested in Russia, and have quietly prepared for a Russian crisis. Toyota broke the silence today, and said it out loud.

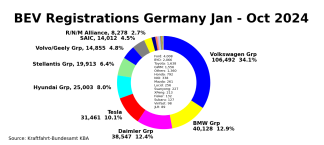

| 2013 Russia sales | ||

| Group | Units | Share |

| Nissan-Renault Alliance | 808,479 | 31.0% |

| Hyundai-Kia | 378,047 | 14.5% |

| GM Group | 318,412 | 12.2% |

| Volkswagen Group | 293,214 | 11.2% |

| Toyota Group | 170,150 | 6.5% |

| Ford | 92,908 | 3.6% |

This chart shows who would be hardest hit. Most major carmakers are affected, led by a Renault-Nissan alliance that holds nearly one-third of the Russian market. Hyundai, GM, and Volkswagen share a similar exposure to the Russian market. FCA’s Russia business is insignificant.

Auto sales in Russia are down 7.6% for the first six months of the year, compared with the same period in an already very weak prior year. Ford’s sales were down 39%, GM’s Chevrolet was down 19%, Renault-owned Avtovaz’s Lada dropped 15%, says the WSJ. The market could come to a complete halt if sanctions bite. If you think that’s impossible, think Iran.