China is one of the very few auto markets to show solid growth, with good prospects for decades. We learned this in yesterday’s installment of Auto Industry 101. Today, we look a little closer at China, as close as the big country allows in less than 1,000 words. This short course is written due to the recent interest in disrupting the auto industry. The course is bite-sized, and kept extremely simple, Auto Industry for the Twitter Generation. Those in the industry will find nothing new. Those new to the industry hopefully will find a helpful primer.

The Chinese auto market is a Tiger. It’s big, it’s fast, and it can eat you alive. Responsible for the huge market are Deng Xiaoping, and western investors. Deng invited western automakers to China. Volkswagen and American Motors followed his call. (If you are interested in the inside story of why and how VW came to China, let me know, and I may tell it. For AMC, ask Michael Dunne.) Then, VW and AMC languished in China for two decades. Nothing happened until western investors started pouring money into China at around the turn of the last century. Fueled by Dollars, Euros, and Yen, the Chinese car market exploded.

I came to China in 2004 on a job for Volkswagen. Back then, you could breathe the air and cross Chang’an Avenue on foot without risking your life. Four years later, both were impossible. In 2009, China was the world’s largest auto market, mostly because the market in the rest of the world imploded. China ignored naysayers and pronouncements of bubble markets, and powered by foreign investment, it kept powering on.

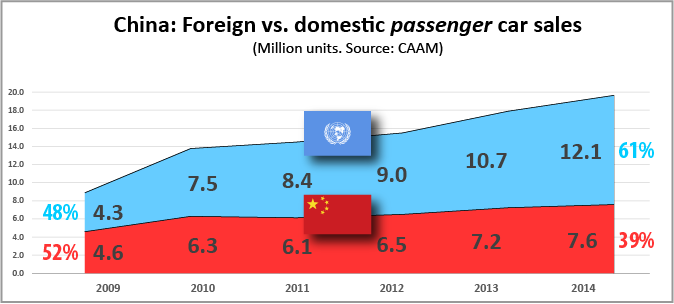

The missing bubble was just one of the predictions that did not come to pass in China. A popular prognosis, shared by many foreigners over their beers at Schindler in Beijing, or Paulaner in Shanghai, was that the Chinese would learn fast, and that they would kick the useless laowei out in short order. Just the opposite happened. Foreign brands are steadily displacing the locals in China. In 2009, around 48 percent of all passenger cars sold in China were Chinese. Last year, the number was down to 39 percent. (Elsewhere, you may see the Chinese number as low as 22.5 percent in 2014. That’s sedans only, and the danger of Google Translate. If you are missing a few million units: Vans, trucks, and buses are counted elsewhere. Still confused? You are not alone.)

Nearly all of the joint ventures are with state-owned companies. Most of the indigenous sales are by struggling Chinese companies. In hindsight, the much maligned joint ventures were the best deal foreign automakers could get anywhere in the world. Imagine an America where the auto business is monopolized by a trifecta of Washington DC, Asian and European automakers, and a powerless UAW, and you would begin to comprehend the state of the Chinese auto industry today.

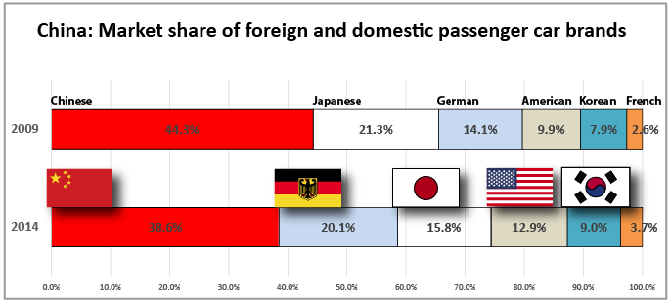

A common misconception is that American cars have it easy in China. Study the chart of the market shares of foreign and domestic passenger brands, and you will see that American brands rank 4th behind Chinese, Japanese, and Germans. Study the chart intently, and you will find a hidden danger of being in China: The business climate suddenly can get as toxic as the air you breathe. In 2009, Japanese brands were the leaders of the foreign pack. If you drove a Toyota, Honda, or Nissan, you showed that you had arrived. In 2012, anti-Japanese demonstrations turned into riots and got out of control, and a Japanese car became a liability in China. The share of Japanese-branded cars dropped from 21.3 percent in 2009 to 15.8 percent in 2014. German-branded cars have replaced the formerly leading Japanese. The share of American brands has grown. However, American brands are still in place 4. Ford made impressive gains in China, but there is only so much a GM and a Ford can do. China amounts to about one third of the sales of both Volkswagen and GM. What powers both carmakers could quickly turn into a liability.

Be it as it may, the Chinese seem to like foreign cars. No true. They like foreign brands.

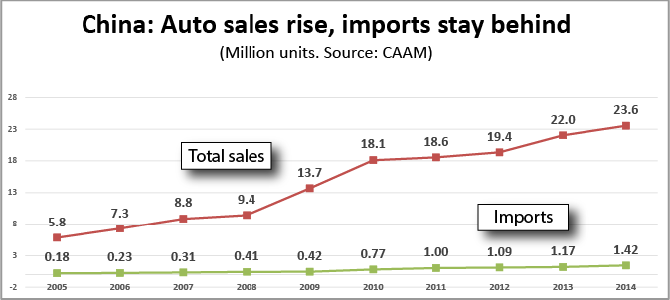

Go to China, and you will swear that it is filled with imported cars. It just looks that way. Most of those “imports” are Made in China by the aforementioned joint ventures. Detroit’s lobbying machine, the American Automotive Policy Council, often paints China as an import paradise, and Japan as a closed market. We are being misled. The share of true imports to China is between 5 and 6 percent, about the same as in Japan.

Thinking that China is an import car paradise can be a painful misconception. Most of the true imports are brought into the country by the import arms of the large Western/Chinese joint ventures, or by large state-owned importers. It is an open secret that the key to successful imports is production in China. With Chinese production, a party functionary works next door, or at the desk across from you. A snag in customs is quickly cleared up by a phone call. No production in China, and you compete with a powerful alliance between western automakers and the government. A few struggling small, high-end brands tried to become big high-end brands in China, and very little happened. Just ask Andy Palmer at Aston Martin.

|

Best-selling passenger vehicles China, February 2015

|

||||

| Rank | Model | Type | Manufacturers | Units |

| 1 | Wuling Hongguang | MPV | SGMW | 51502 |

| 2 | VW Lavida Sedan | Sedan | Shanghai VW | 36062 |

| 3 | VW Santana | Sedan | Shanghai VW | 26477 |

| 4 | Baojun 730 | MPV | SGMW | 24502 |

| 5 | Hyundai Elantra Langdong | Sedan | Beijing Hyundai | 20457 |

| 6 | Haval H6 | SUV | Great Wall | 20186 |

| 7 | VW Sagitar | Sedan | FAW VW | 19673 |

| 8 | VW Tiguan | SUV | Shanghai VW | 18796 |

| 9 | VW Jetta | Sedan | FAW VW | 18640 |

| 10 | Chevrolet Cruze | Sedan | Shanghai GM | 18520 |

| 11 | Hyundai Verna Sedan | Sedan | Beijing Hyundai | 18498 |

| 12 | VW Passat | Sedan | Shanghai VW | 18387 |

| 13 | Buick Excelle | Sedan | Shanghai GM | 18247 |

| 14 | Chevrolet Sail Sedan | Sedan | Shanghai GM | 17172 |

| 15 | Ford Escort | Sedan | Changan Ford | 16827 |

| 16 | Chana Honor | MPV | Changan | 16262 |

| 17 | JAC Refine S3 | SUV | JAC | 16193 |

| 18 | VW Bora | Sedan | FAW VW | 15394 |

| 19 | VW Polo | Sedan | Shanghai VW | 15280 |

| 20 | Changan Eado | Sedan | Changan | 15051 |

| Source: China Passenger Car Association CPCA | ||||

Now that you are an expert on the Chinese car market, you will no longer fall for the undying Internet trope that the best-selling Chinese car is a Buick, because the Chinese Emperor owned one, or even two.

The absolutely best-selling car in China currently is the Wuling Hongguang, a cheap MPV that is also marketed in India as a Chevrolet Enjoy (to the very limited joy of the Indians.) The first Buick on the list is the Excelle in place 13. Emperor Puyi was bought by the Japanese, sat in jail for 10 years as a war criminal, and has little influence on today’s Chinese car buying habits.

This installment of Auto Industry 101 is quickly approaching the 1,000 word self –imposed limit, so let’s stop for today. Next in Auto Industry 101, we will try to shine light on one of the most inscrutable parts of the Chinese Auto Industry: EV sales. With that part of AI 101, you will be able to render an expert opinion on whether it is smart to target China as a key export market for EVs.