For more than ten years, every word a certain top executive of Volkswagen uttered in public was pure BS. I wrote his speeches. I wrote articles under his name. I even ghostwrote a book for him. I studied his mannerisms, his way of thinking and talking. He slowly but surely slipped into the role for which I wrote the script. He’s retired now, but still is a sought-after speaker on the conference circuit.

He liked to live and work on the edge, and I gladly walked him there. We had a strange symbiotic relationship. His trust in me bordered on the obscene. Even before major strategy announcements, his brief for the speech usually amounted to: “You know what to write.” He rarely did read the speech before giving it. He always delivered it with great aplomb and usually to thundering applause. I could put practically any word into his mouth. Power that had to be used wisely.

Twice a year, there was an international conference during which the top brass of VW’s many outposts throughout the world congregated in a European city. My job: write the keynote speech that opened the event. Then write the wrap-up speech for the finish.

The keynote speech could be written at leisure. The wrap-up speech was always written under great duress: I had to make summations of remarks by other executives that they had yet to make. The other execs played their speeches close to their chests and wouldn’t surrender their manuscripts. I finally struck a secret deal with the simultaneous translators: They would trade the classified manuscripts for the supposedly off-the-cuff closing remarks of my guy.

And again, a conference came to an end. I was slap-happy from a lack of sleep. It was his time to give the closing remarks, for which I had pulled an all-nighter, as usual.

He headed for the podium, then stopped and gave me that “come hither” wave.

“We’ve got to change the speech.”

“We’ve got to what?”

“Change the speech. Something came up.”

“Are you nuts? You are going to be up there in 30 seconds. How am I to re-write a speech which you will give in — 25 seconds?”

“Change the speech. Something happened. Something about China.”

“What happened?”

“Gotta run. Showtime. You know what to write.”

And off he went into the varilights.

As usual, I had no idea what he was talking about. I asked around. My spies rolled their eyes. It turned out that during the conference, a silly speaker had used the phrase “You in China.”

This had bothered the two Chinese delegations to no end.

To this day, Volkswagen’s business in China is run by twins who don’t get along.

Volkswagen’s joint venture partner FAW in the North is the bitter enemy of Volkswagen’s joint venture partner SAIC and the SVW venture in the South. There is no “You in China” in the eyes of the Chinese. At least not as far as VW is concerned.

Slipping a changed speech on the fly to my guy was easier than I had thought in my first shock. There was a video segment towards the end, during which a revised manuscript could be swapped with the old one.

I, however, was in a foul mood and wanted revenge.

I sat down and typed away. The printer purred. We were up to 18 point Courier—his eyesight had weakened and he was too vain to wear glasses on stage. The video came. The manuscript was swapped. I even kept my deal with the simultaneous translators and gave them the revised version to be translated into many languages.

End video. Spot on speaker:

“Ladies and Gentlemen, we nearly had a diplomatic incident at the conference,” he intoned with his usual gravitas.

“Apparently, someone carelessly referred to China as China.”

That got the interest of the two Chinese delegations. Their ears perked up.

“Ladies and Gentlemen, we are fully aware of the importance of the One China Principle.”

The Chinese delegations developed a distinct “WTF?” expression on their faces.

“We know, the One China Principle is dear to the heart of our Chinese friends. But . . . ”

Panicked looks from both Chinese factions.

“But this is Volkswagen, and as far as Volkswagen is concerned, the One China Principle does not exist!”

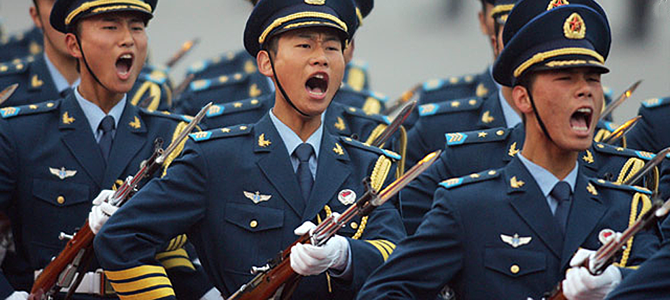

The Chinese delegations, at the time with short cropped hair and with a certain military bearing, because that’s where they had worked before (or were still) suddenly sat ramrod straight in their seats.

“Get it in your heads, there is no ‘One China’ at Volkswagen!”

Some Chinese went pale and gasped. Mouths dropped.

The rest of the audience—not as much in tune with Chinese politics as they were with corporate politics—was mostly oblivious.

“The One China Principle doesn’t exist at Volkswagen. There is FAW-VW in the North, there is SVW in the South. Keep that in mind and keep it apart.”

The Chinese delegations exhaled, looked at each other. One Chinese tried on a sheepish grin and it was returned by the other Chinese. Then they laughed, and finally broke into a roaring applause. The rest of the audience, still oblivious, but polite, joined in.

When the speech was over, both Chinese delegations rushed to the podium, slapped him on the shoulder, pumped his hand, a chorus of “xie xie!” and “heng hao!” ensued, one ebullient and short-cropped Chinese even hugged him.

He took the adulations in stride.

Then he waved me over and whispered:

“What did I say?”

This story from the SWWE (Stories We Wrote Elsewhere) archives appeared first on May 31, 2009 in Thetruthaboutcars.com