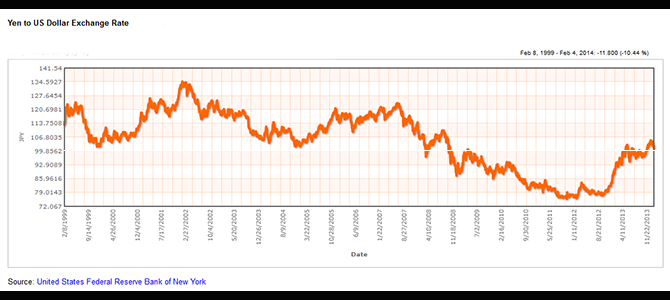

Last year, the Japanese yen returned to barely normal from vastly overrated (those who call the Japanese currency “undervalued” are invited to Tokyo to see how far those allegedly cheap yen go – taking the subway to the press conference and back costs $10). No one was more relieved about this than Japan’s second-tier automakers. With most of their production still in Japan, companies like Mazda or Mitsubishi suffered the most from the obscenely high currency. Now suddenly, it is possible again to make a profit by making cars at home. For the first nine months of its fiscal, Mazda booked an operating income of 124.6 billion yen ($1.23 billion), up 534%. Mitsubishi Motors delivered operating income of 55.4 billion yen ($548 million) in the same period, an increase of 135%.

In order to block the trade deal with Japan, and to preserve the 25% tariff that protects American trucks from nasty imports, Detroit started to rant against an imaginary closed market Japan, and even more imaginary currency manipulations.

No one was seething more about Detroit’s “currency manipulation” rhetoric than Mazda. Mazda was essentially Ford’s Japanese colony from 1979 through 2010. For many years, it had Ford-sourced management (1996 Henry Wallace, 1997 James Miller, 1999 Mark Fields.) During that time, nobody at Ford complained about closed Japanese markets, or undervalued currencies, despite the yen being much cheaper against the dollar than today (March 2002, 134 yen to the dollar). When Ford was in financial trouble in 2008, it sold most of its interest in Mazda, and while doing so, it profited from a much stronger yen which bought more badly needed dollars than ever before. If anyone gained from the yoyo movements of the yen, it was Ford. Some say, Ford owes its life (or its avoidance of a government bailout, which, due to Ford’s conservative leanings, would not have been as benign as that of liberal-leaning GM) to Mazda and the yen. The abandonment by Ford left Mazda with very few foreign production bases – essential for survival during the high yen times.

Mitsubishi Motors likewise is a victim of worldwide wrangling. After the merger of Daimler and Chrysler, Mitsubishi Motors was bought to support global ambitions. Daimler did not want to shoulder Mitsubishi’s debts. Mitsubishi was off-loaded to a private equity group, and eventually landed back in Japanese hands.

As Reuters reported, Mazda is working on technology that possibly “can make the century-old internal combustion engine as fuel-efficient as hybrids like its rival’s pioneering Prius.” When there will be an awakening from the electric dreams, Ford may regret that it sold Mazda.