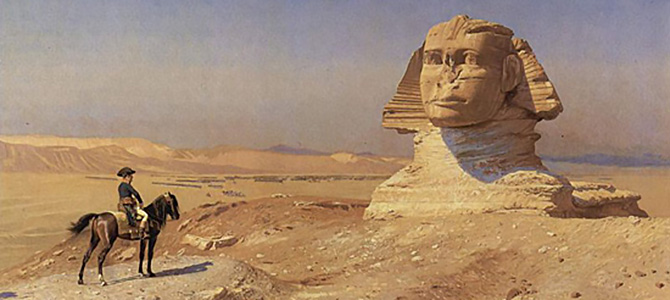

I met a traveller from an antique land

Who said: “Two vast and trunkless legs of stone

Stand in the desert. Near them, on the sand,

Half sunk, a shattered visage lies, whose frown,

And wrinkled lip, and sneer of cold command,

Tell that its sculptor well those passions read

Which yet survive, stamped on these lifeless things,

The hand that mocked them and the heart that fed:

And on the pedestal these words appear:

‘My name is Ozymandias, king of kings:

Look on my works, ye Mighty, and despair!’

Nothing beside remains. Round the decay

Of that colossal wreck, boundless and bare

The lone and level sands stretch far away ~Shelley, “Ozymandias”

Ed note: Jordan Terry of Stone Street Advisors recently asked me on Twitter what I thought of the “bad” situation at GM Korea, noting that it seemed “underreported.” Having written about the subject in the past at TTAC, that was hardly a surprise: not much hard reporting comes out of GM’s “International Operations” black box. That said, there is a broader context here that is underreported, and which I will try to lay out here…

General Motors Korea, formerly GM-Daewoo, has been a key design, engineering and export hub for GM’s global empire since the early 2000s. Specializing in smaller cars, developed and produced at lower price points than GM’s European Opel division, GM Korea was the main conduit for many of GM’s developing-market efforts, as well as the “home room” for many global products. For the perennially small-car- and cost-challenged GM, Korea was the key to offering affordable small cars for export to developed markets like the US and Europe in complete form, as well as in the form of CKD kits for developing market operations like GM Uzbekistan and GM Egypt.

But GM Korea’s long-term problems with union unrest, currency volatility and domestic market sales declines are catching up to it, creating a financial crisis just as it becomes increasingly expendable to the GM Mothership. GM’s deep alliance with China’s SAIC Motors has made GM Korea all but irrelevant to its strategy, and as The General plots its increasingly China-centric future it’s clear that Korea is losing out. With the loss of key export markets and future development work, GM’s once-crucial Korean empire is fading into obscurity and financial woes.

The trouble for GM Korea became unavoidable just over a year ago, when GM pulled the plug on Chevrolet Europe at the reported cost to GM Korea of 150,000 units of export volume starting this year. GM headquarters then told GM Korea to shoulder the cost of its strategic decision, a move BusinessKorea compared to being “stabbed in the back after following instructions from its parent company.” GM only kept the lid on union anger last year by promising to bring next-generation Chevrolet Cruze production back to Korea, and was spared a strike in exchange for a more tangible $10,000 per worker in bonuses and incentives.

But promises to replace Korea’s exports to Europe with more Australia-market exports were cold medicine, with just just one third the volume (40k units/year versus 120k units/year) and internal competition from new Opel-sourced Holdens. And even if GM does bring Cruze production to Korea’s Gunsan plant, it won’t be enough to stop job cuts: in December, GM Korea told workers it would lose $36m per year if Gunsan remained on double daytime shifts, posing the risk of further cuts at the 60% capacity plant. Gunsan will be an “overflow” plant (at best) for the new Cruze, which has already debuted in China just as its predecessor debuted in Korea. Even the Korean Chevrolet Spark is beginning to be exported from GM India, a move that Korean unions interpret as a challenge to Korea’s export primacy in GM’s Asian strategy.

GM Korea did restart production of its low-cost Damas and Labo minitruck/vans last August, but only after receiving a special grace period for the vehicles from new safety and emissions regulations that had put them out of production. Raising the price now and rolling its “innovative” new compliance features in “phases,” GM Korea is spending just $20m to update a mini commercial vehicle lineup that has no competition in its home market. It does, however, have a competitor in the cheaper Shanghai-GM-Wuling microvans that have been exported from China with Chevy bowties since 2009.

This competition with GM’s Chinese production and development efforts points to the roots of GM Korea’s decline. GM had long used GM-Daewoo as the conduit for building up its Chinese operations, transferring technology and expertise from Korea to fledgling operations in China. This dynamic accelerated in 2009, when GM Korea desperately needed money to restructure and GM mortgaged its “golden share” in Shanghai GM for nearly half a billion dollars in Chinese bank loans with which to shore up its crucial Korean division. Though the details of that transaction have been shrouded in mystery, it’s now clear that GM’s Chinese bailout brought GM and SAIC closer together, at the expense of GM Korea. Having transferred the technology for Daewoo’s now-aging products to Chinese Joint Ventures, and having built up its engineering and production facilities in the Middle Kingdom, GM Korea has little to offer the corporate parent besides some remaining design and engineering facilities.

And the trouble is likely to continue for GM Korea, per this disclosure from GM’s Q3 10-Q filing:

We are addressing many of the challenges in our GMIO operations and have strategically assessed the manner in which we operate in certain countries within GMIO. We announced the withdrawal of the Chevrolet brand from Western and Central Europe and the ceasing of manufacturing and engineering operations in Australia by 2017 and incurred impairment and other charges in 2013. We continue to execute to these plans and within the financial impact that we projected. As we continue to assess our performance throughout the region, additional restructuring and rationalization actions may be required. With the significant reduction in wholesale volumes and forward pricing pressures, we tested certain long-lived assets for impairment and additional testing may occur in the near term. Determining whether long-lived assets need to be tested for impairment, whether recorded amounts are recoverable and the estimate of impairment and other charges, if any, is subject to significant uncertainty and highly dependent on finalization of our strategic assessments.To address the significant industry, market share, pricing and foreign exchange pressures in the region, we continue to focus on product portfolio enhancements, manufacturing footprint rationalization, increased local sourcing of parts, cost structure reductions, as well as brand and dealer network improvements which we expect to favorably impact the region over the medium term.

GM’s Korea-based empire has all but crumbled, stripped of its European exports and global development responsibility. GM’s Singapore-headquartered “GMIO” represents the last remnants of this once-mighty operation, and even that appears to be restructuring into insignificance. China’s SAIC has replaced Korea’s Daewoo as GM’s main low-cost and developing-market partner, leaving little for GM Korea to to do besides supply a few small developing markets where it is already established. Having rescued GM’s Asian operations, SAIC is now the new power behind GM’s global strategy and it will continue to funnel new engineering and production work to its strongholds in China and India. As a result GM’s previous partner, Korea, can do little but watch its former might flow away. Like other US allies with major GM operations, namely Australia and Canada, Korea is simply the latest outpost of GM’s empire to be swamped by the global ripples from GM’s 2009 restructuring.