Last week, InsideEVs said that Tesla sold 3,500 Model S in the U.S. in December, outselling Nissan’s best-selling Leaf. Nissan sells more of its all electric Leaf in the U.S. alone (2014: 30,200) than Tesla sells Model S world-wide (2014: ????), but then there is that ADD epidemic to reckon with. Reduced to “Mosdel S sells more than Leaf” (140 chars, you know) the report quickly did ricochet through Tesla’s premiere PR platform, Twitter. Twitter is a battleground of Tesla Longs and Shorts, yelling at each other 24/7, and even the flimsiest piece of data is used like the Rev. Jeremiah Wright treats the gospel. The problem is: Not just the perception given is wrong. InsideEVs’ Tesla number is made up, pulled straight from thin air. Or possibly worse.

Sounding a bit fishy, the InsideEVs number was put into question by a few business sites, casting faint rays of doubt upon the report. At the Daily Kanban, we have two, much bigger problems:

- All U.S. Model S reports you can read so far are wrong.

- Barring an external audit, we will most likely never find out who is right.

Tesla is a teeny-weeny car company that already is valued like a big one. The stock market thinks that Tesla is worth around a third of the world’s second largest carmaker Volkswagen, a company that sold more than 10 million units last year. How many did Tesla sell worldwide? We don’t know yet, we need to wait for their annual report. The guesstimate is a bit under 30,000. How many did Tesla sell in the U.S.? We’ll never know. Tesla does not release that number. Unlike most car companies, which release monthly sales numbers, broken out by region, Tesla releases only one global number, only once a quarter. Why? According to Tesla, it is done to spare reporters the ignominy of embarrassing themselves. Said Elon Musk in a recent conference call:

“Part of the reason why we don’t release the monthly deliveries number is just because it varies quite a lot by region and the media tends to read all sorts of nonsense into the deliveries. So, we’ll have 1,000 cars reach a country one month and none the next month or 100 the next month trickle in because those are the numbers that were registered one month versus the next. People will say, ‘oh, wow, Tesla sales drop by a factor of 10.’ ”

By not releasing numbers, Tesla creates much bigger nonsense. As long as Tesla does not release robust numbers, they will be made up elsewhere.

If Musk would have been in the car industry a little longer, he would know by now that the auto business runs on statistics even more than an army marches on its stomach. Professional car counters abhor the vacuum of empty data fields.

Each month, usually on the first, all car companies in America issue their monthly sales number, which is entered in tables, processed, analyzed, and tweeted. The Federal Reserve and the stock market examine the data as a vital sign of the economy. Miners of iron ore, smelters of aluminum, makers of chips, rubber, and door panel fasteners use the data for planning. Bloggers turn them into yet another insufferable click-baiting iteration of “The 20 hottest cars of the month.” Sites like us collect the data to give you a handy month-by-month reference.

The problem is: Each month, the Tesla number is wrong.

All car companies issue the monthly sales number, except one: Tesla. In the beginning. Tesla was simply ignored. No number, no entry. Now that Tesla no longer can be ignored, numbers are simply estimated. If you look hard enough, you will find a little star, or a footnote next to the number. There are no footnotes on Twitter, and within seconds, the fabricated number becomes reality. There is an even bigger problem.

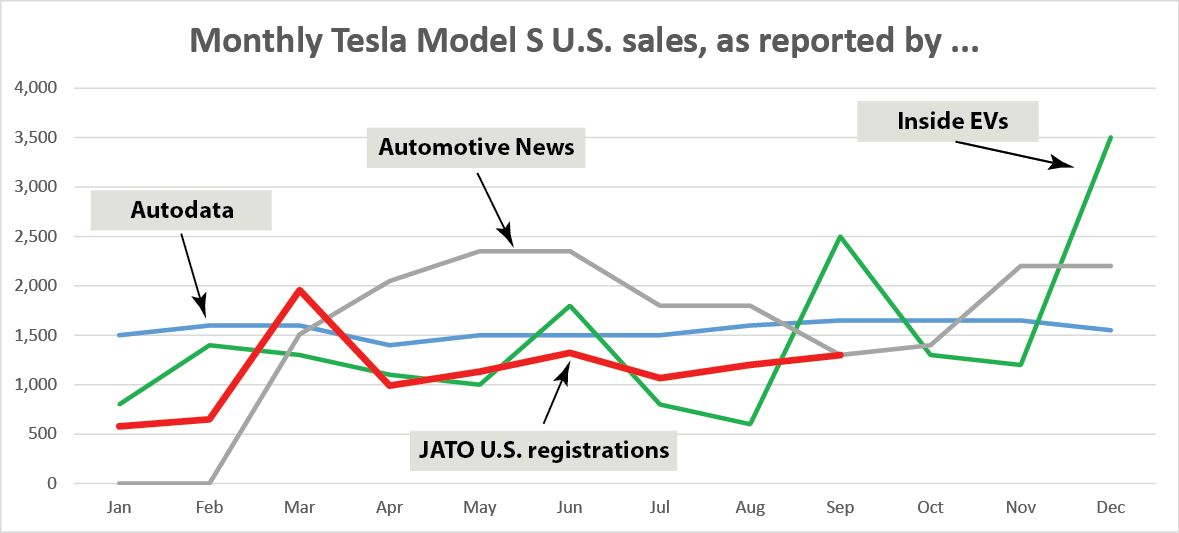

One would believe that the estimates are at least educated guesses. If so, a common pattern would emerge. It does not. In the chart above, we plotted month by month the Tesla Model S sales estimates made by two of the most respected data sources in the industry, Automotive News and Autodata. We also added the estimates rendered each month by the go-to site when it comes to data on electric vehicles, InsideEVs. As you can see, the guesses do not agree at all. Tesla’s monthly sales depend on who gives them to you. In the alleged record month of December, Autodata guessed 1,440 units, Automotive News guessed 2,200 units, InsideEVs thinks it’s more like 3,500 units. The crimes against statistics go unpunished. The only one who could debate the guesses is Tesla, and Tesla isn’t talking.

However, there is one source of intelligence that should come at least close to reality: Registrations. Assuming that people want to drive their cars, the cars need to get registered. Motor vehicles departments keep count. Each month, research companies collect the data. One of those is a British company, JATO, which is relied upon by the research departments of many large OEMs. JATO’s findings are plotted in red. While registration data should come closest to reality, at least much closer than simple guesses, they remain wrong.

Each Model S that is bought by a straw man, only to be loaded on a boat to China, ends up as a registration in America. Don’t shrug that off as a rounding error. Grey imports of Model S to China were so rampant that Tesla issued a note denying warranty service. The problem can only get bigger. China announced last week that it will allow parallel imports of cars on a trial basis, thereby legalizing something that has been going on for years. China isn’t the only market for grey imports. Cars float to and fro across the seas, depending on the ebbs and flows of currencies and other factors.

Furthermore, registration data are subject to manipulation. Dealers, even automakers “buy” their own cars, register them for a day, then put them back on the lot, or ship them to another country, where they may show up in the new car statistics again. In Europe, the share of “registered, but not sold” cars can be huge, 30 percent is accepted as normal. For all of these reasons, registration data should be regarded as optimistic.

Then, there is the biggest problem of the registration data: They can take 60 to 90 days to collect and tally. By that time, they have lost their significance.

One thing should be noted: InsideEVs is no professional data house. It’s a specialist car blog. Good reporters they are, they should have their sources. The zig-zagging green line of the InsideEVs estimates suggests inputs different from the more mechanical factors guiding the guesses by Autodata and Automotive News. The InsideEVs plot also reflects the general trend (but not the magnitude) of the monthly registrations, data that only become available months after the plot has thickened. At least in the last two quarters, InsideEVs depicts a Tesla-typical tendency towards very strong last months of the quarter. There were unconfirmed rumors swirling around the industry-types that arrived in Detroit for the annual Motor Show confab that there was an especially mad rush at Tesla to ship as much as possible in the last week of December, something InsideEVs’ plot could reflect, while the other plots idle through tranquility. Comparing registration trends with those of the InsideEVs plot, the latter appears as the most educated guess on the table.

How does InsideEVs receive that education? Let’s eliminate: Official numbers? No. None until the year-end report, and then only globally. Registrations? No. Won’t be available for months. So what remains? InsideEVs proudly, if somewhat obliquely says about its Tesla data:

“We actually put in a little research/tracking effort into the estimated number of deliveries in the US and attempt to explain what is happening behind the scenes.”

Does InsideEVs have an inside source? Ed and I have been in the blogging “business” for a few years, and we had those inside sources. They usually had a vested interest in what they “leaked” to us. And they did not mind if we erred a bit in our gusto for becoming the Woodwards and Bertels of the autoblogging world. It was our problem if we were found out. But then, there is so much nonsense written in that genre that no-one can keep track anymore.

And with that, I leave you to your own conclusions. While you do that, be careful out there, and always rely only on statistics you have forged yourself.