Yesterday in Auto Industry 101, we covered the tepid growth of the same. Today, we look into where the industry is growing, and where is doesn’t. This short course is written due to the recent interest in disrupting the auto industry. The course is bite-sized, and kept extremely simple, Auto Industry for the Twitter Generation. Those in the industry will find nothing new. Those new to the industry hopefully will find a helpful primer.

For the last 10 years, the global auto industry has grown at an average annual rate of just 3.4 percent. Ten years ago, 66 million automobiles were sold worldwide. In 2014, it was 88 million. Let’s begin with a look at where the auto market definitely is not growing.

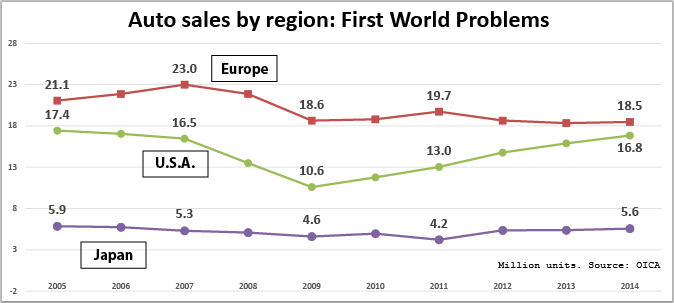

- The European car market has been in a steady downtrend for a decade. Realistic observers with an eye on population statistics predict the EU market to stay in the doldrums for a long time.. Europe has a surplus of cars and car factories. Dealers and automakers are so desperate for sales, they buy their own cars. What is keeping the industry alive is the low Euro. Car exports from Europe are good business. Car exports to Europe, not so much.

- America looks vigorous, but it isn’t. After losing nearly half its size in 2009, the American market finally managed to claw back to where it was ten years ago. With 800 vehicles per thousand people, the U.S. market is the most saturated in the world. (Well, San Marino has a few more. It’s a tax dodge.) The market shows signs of leveling off.

- Japan is going sideways, and is trending down. Japan is said to be a closed market, which is not true. It is a tough market with seven world class domestic automakers and very demanding customers.

Where in the world is the growth?

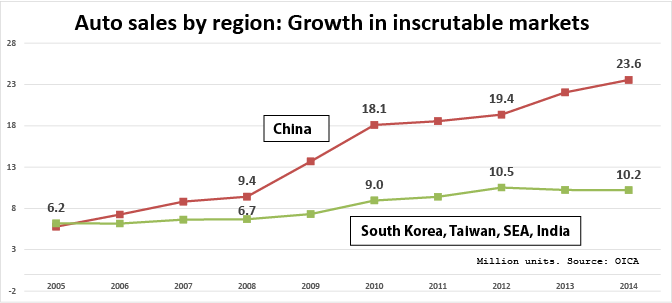

China definitely is the market to be in, and nearly everybody is. Growth projections of the global auto industry rest on an (officially) communist country, where Twitter, Facebook, and Google are blocked. To have a chance of succeeding in China, one needs to produce in China. Import duties are high, and the officials can be a bit unpredictable. To produce in China, you need a joint venture partner, and you need to share the proceeds of the sales 50:50. The interesting joint venture partners are all owned by the government, one way or the other. The joint venture partner would provide the land, you the rest. Before that, you need a pile of permits. This can take 5 years, with no guaranteed outcome.

Once in China, you fight with the world’s biggest, very much alive automakers. You also fight an army of rabid zombies. There are more than 100 registered automakers in China. According to the government, only 10 of them should be alive. The Chinese government tried to euthanize the rest. It does not want new automakers. China’s big cities are suffocating in traffic, more and more have rationed cars. However: With a car density of only 100 per thousand people, the world’s (arguably) largest economy has a long way to grow. Until China reaches the G7 average of around 1 car for every two people, China needs to put 700 million cars on the road.

There is another, often overlooked part with a lot of growth: China’s southern and eastern periphery is interesting, South Korea, Taiwan, South East Asia all the way to India. It is a complex and challenging market, a lot of it with entrenched players, and as the graph shows, it is not all gravy. Most of that area is firmly in the hands of the Japanese.

To partake in the world’s most vigorous car markets, one ideally would have to produce in China, and after that possibly in Thailand. One would be very late to the game. Volkswagen, the largest player in China, started there in the early eighties. It had to bring a lot of money, and a lot of patience. The China business began to bloom only 20 years later. GM started in 1997, and it also had to be patient. Exports are challenging anywhere in the world, but especially to Asia, and especially from the U.S. The high dollar does not help at all. As long as America balks at trade pacts, it’s much easier to export from Mexico.

Let’s recap: You do not want to start a new car company in Europe, in America, or Japan. If you aren’t in China with your car business, you don’t partake in the most vibrant car market, now and in the future.

It’s a bit late to come to that realization now. As we will see in tomorrow’s installment of Auto Industry 101: The trouble with China