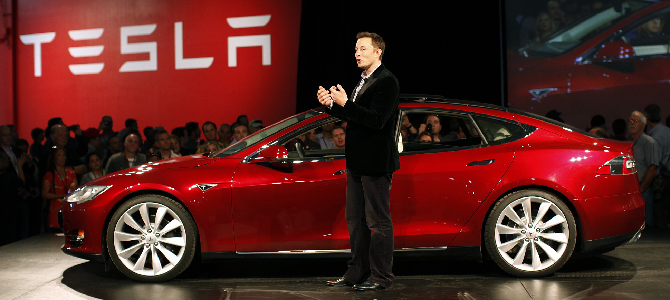

Last weekend, Tesla CEO Elon Musk said “speculators and scalpers misled the company” to believe that demand for the cars was “extremely high” in China, as China’s government-owned news agency Xinhua reported. Cars were ordered, and shipped to China. When the cars arrived in China, many people canceled their orders, and thousands of Model S ended up unsold in warehouses. Let’s try to find out who was misled by whom. What did Elon Musk really know, and when did he really know it?

Before we do that, how many cars are we talking about? The South China Morning Post puts the number of unsold Teslas in China at 1,600. Carnewschina thinks the number is closer to 2,300. And was it really such a surprise revelation? Two months before Musk’s sudden epiphany The Wall Street Journal, using data from JL Warren Research, already had said that nearly half of all Model S shipped to China in 2014, or 2,261 out of 4,761, were not registered. Four months ago, the DailyKanban sifted through worldwide registration data, and found a shortfall of 4,000 units globally, with China the biggest gap.

And who are those “scalpers?” Elsewhere, the scalper would be called an arbitrageur, a dealer who bridges a gap between supply and demand, between high price and low price, between sales target and actual sales. Scalpers/arbitrageurs are a necessary and balancing ingredient of free trade and capitalism. In China, the biggest scalpers sometimes are the car dealers themselves. When a car needs to be brought in from far-away lands, “it is common practice for Chinese luxury car buyers to pay an extra premium (which may amount to as much as 25 percent of the manufacturer’s suggested retail price) if they want to buy a popular luxury model reasonably quickly,” writes China Daily.

In the case of Tesla and China, there are two types of arbitrage.

- Cars are bought abroad and brought to China.

- Cars are ordered in China through Tesla stores and sold elsewhere.

Case 1 was common before the Model S was officially available in China. Real Model S deliveries to China did not start before May 2014. Months before, one could buy a Model S from grey market dealers in Tianjin and elsewhere, fresh off the boat from California, and still with the U.S. tag on the car, for a premium of $13,000 above Chinese list.

The relatively tame mark-up should have been a warning sign for Tesla. OEMs monitor the prices paid at grey market dealers closely as a gauge of demand and pricing power. Tesla was aware of these grey market activities before the first Models S officially arrived in China. Said a May 19, 2014 email by Tesla’s China spokesperson Peggy Yang:

“Tesla China released a blog on our China website in March 2014 to inform and remind Chinese customers of our official sales channels. Tesla has not authorized any 3rd party re-sellers to sell Tesla vehicles in order to ensure that all Tesla customers can enjoy the best user experience and service.”

In this blog post, Tesla asked customers to report when Tesla cars are offered through outside channels. Tesla also denied warranty coverage to “vehicles imported from other markets.”

Once Tesla cars were officially available in China, scalpers/arbitrageurs shifted to method #2 and ordered in China. Their activities were helped by Tesla sales policies, Tesla’s scalper problem was entirely homemade. In the May 19, 2014 email to the DailyKanban, Peggy Yang wrote:

“Tesla China has officially begun deliveries in China. Tesla China has already received all required certification and is now legally delivering vehicles to customers since April… Tesla continues to deliver to customers when their home charging validation is completed (ie, after charging stations are installed at their permanent parking space at home or wherever they choose to, e.g. their office building) and when Tesla service centers are opened in their city.”

In doing so, Tesla had limited its potential customers in China from more than 1.3 billion to a few thousand. At the time of Peggy’s letter, service centers were only open in Beijing and Shanghai, and Teslas could officially be bought only by 3 percent of the Chinese population – if they had a permanent parking space where a charging station could be installed, which put the car well out of reach of most high-rise-dwelling Beijingers, or Shanghaiists. Scalpers/arbitrageurs bridged the gap between Tesla’s rigid rules and Chinese customers who wanted their Model S without waiting, or who wanted to drive it in a town without a service center, or without having their own parking spaces.

In China, Tesla started accepting pre-orders for its Model S in April 2013, a year before the model S officially became available in the country. As of September 2013, Goldman Sachs analyst Patrick Archambault was quoted as saying that Tesla already had 4,000 preorders in China. By the end of the year, the number reportedly had grown to 5,000.

Fast forward to April 2014, when the first Model S officially arrived in China. Belatedly, “customers residing outside of the Beijing and Shanghai areas” were told that, as per Tesla policy, they would not get their pre-ordered cars until service centers are established in their cities. Pre-orders were taken for cars Tesla was not willing to deliver. Tesla customers felt misled. One of them smashed the windshield of a brand-new Model S in a Tesla store, with camera crews from China’s CCTV in attendance. The news program on state-owned TV quoted legal experts, who said “Tesla’s sales behavior to Chinese customers is suspected of fraud.” Duped customers were heard from through their lawyer, an article in PingWest said. The duped public should have been told a year ago that pre-orders would go unfilled.

According to the article, the limits to the Chinese market were not the product of some “braindead” Chinese employees, but the result of mismanagement at the Tesla headquarters in California. To overcome the home-made limitations, says an article by JL Warren,

“the China team needed an expansion in customer service, public relations, business development, and charging networks before launching a new product. However, when Chang asked for new hires in these areas, Tesla’s headquarters refused his request. Yet they were always willing to provide budget support to bring on new sales staff. Eventually, Chang realized his Tesla China team was only supposed to be a sales team.”

Chang was Kingston Chang, a veteran high end car expert. Before Tesla, he was the General Manager of Bentley in China, and he did well. At Tesla, Chang implemented the Tesla store according to the official teachings of Musk, only to find himself sidelined by former Apple executive Veronica Wu, and her totally heretic sales strategy. Veronica quickly realized that Tesla, and its pressurized Chinese salesforce could only unlock China’s vast market with the help of the scalpers/arbitrageurs. After all, she had learned that in her previous job at Apple, where she “managed and owned P&L and operations of all non consumer sales channels for the Greater China.” In other words, Ms. Wu was head of Apple’s grey marketing dept. Just like Teslas, iPhones were brought into China by enterprising arbitrageurs long before their Chinese market launch. Just like with Teslas, it is a myth that iPhones can only be bought at the official company store in China. You can get a genuine iPhone in markets throughout the country. China’s version of eBay, Taobao, overflows with iPhones. The demand is served via bulk sales, ostensibly to enterprises, but wink-wink, nod-nod, everybody knows where those phones really go.

The auto-equivalent of “enterprise marketing” is “fleet sales.” Says the Pingwest story, translated by JL Warren:

“As Wu joined Tesla at the end of 2013 … Tesla China started to do fleet sales, meaning the focus of marketing was now on big companies, institutions, government bureaus, and car rental companies that could place bulk orders, rather than individuals. Ms. Wu was in charge of this effort.”

Many of the cars that presumably went to “big companies” ended up with resellers. The supposed fleet sales had another advantage for Tesla’s beleaguered salesforce. With fleet sales, the limitations of needing a Tesla service center in town did no longer apply. According to the JL Warren report, “fleet sales were supposed to be operated in areas without a Tesla showroom.” Soon, a fleet sale was anything beyond five cars in one order, the report says.

Quickly, there were news in Chinese media about massive fleet sales. Several companies were reported making orders for 100 Model S. One company was said to have ordered 1000. The stock market site Seekingalpha even had a story speculating about Chinese taxi companies switching to fleets of Teslas.

In hindsight, it looks like most “fleet” sales were just a flimsy cover for sales to resellers. According to Forbes, JL Warren analysts shared the Seekingalpha story about fleet sales and Tesla taxis with “Chinese auto dealers and sales managers. The reaction was unanimous: they all laughed their heads off.”

According to the report, Tesla headquarters was aware of the fleet sale shenanigans more than a year ago, because “on March 3, 2014, bulk orders by individuals or institutions were banned. Afterwards, no one could place more than five orders at once. Soon after the policy came out, people in Tesla leaked information to PingWest that they were receiving orders of four cars (broken from otherwise too –large-orders), as counter policies.”

In September 2014, the trouble signs were visible from the outside. More than 2,800 Model S were listed as imported to China, but only 432 received the license plates. The LA Times wanted to know from Tesla what was going on. Then Tesla spokesman Simon Sproule said: “There have been some scalpers — people have tried to buy up large consignments of vehicles. But that’s not been a significant factor in China.” A week later, it became known that Sproule would leave Tesla for Aston Martin. I know Simon Sproule quite well from his days at Nissan. He ignored my recommendation to take away Musk’s Twitter password, but as a first-rate PR man, Sproule never lied. He may have been left in the dark about the cancellations, but he did not lie this time either. The people who tried to buy up large consignments were not the considerable factor. The big problem was the people, or entities, who actually placed orders, who made a small down payment, and who bailed when Teslas could no longer be sold at a markup. The considerable factor was that their non-payment was condoned by Tesla, and that the cars were shipped.

According to Carnewschina, cancellations began to snowball in October 2014:

“Officially, Tesla China used a two-phase deposit system: 15.000 yuan ($2394) when the car was ordered and 250.000 yuan ($39.920) when the car was ready to be shipped to China. In reality however, Tesla China only collected the first deposit, with another anonymous ‘Tesla insider’ saying that collecting the second deposit was “too difficult”. This lenient policy caused a lot of cancellations.”

If collecting only one $40,000 deposit did become “too difficult,” the home office, and its self-confessed “nano-manager,” Elon Musk, should have known immediately and taken immediate action. Musk is known to have fired people for much lesser offenses than not collecting $40,000. Those missing $40,000 per car impacted Tesla’s cashflow: Not quite coincidentally, it takes around $40,000 ($3,600 shipping, $19,000 customs, $17,700 VAT) to get the car released from Customs. With the customer’s money missing, the company has to fork-up the cash. The $17,700 in VAT will be refunded when the customer takes possession, but not until the customer does.

Demand had turned into customer flight. People abandoned their $2394 down payments as a price for not having to take a Model S. However, in November 2014, Elon Musk said at a conference call that “demand is not our issue,” that there is “more demand than we can really address,” and that “there was just nothing left to sell.” If the reports above are true, unsold Model S already had started to pile up in Chinese warehouses.

Musk and Tesla were given another chance to own up on the shortfall when a few days after the conference call, John Lovallo, a research analyst at Merrill Lynch, went through the data he was given, and figured that Tesla could have “approximately 3K vehicles stocked in inventory or in transit.” This was in November, long after the cancellations supposedly had started to snowball. Tesla was not heard from. Instead, Lovallo was ridiculed on-line for not knowing the difference between his derriere and cost of goods, and for overlooking that those thousands of cars were on the boat to China. Tesla hid behind its oblique disclosure policy, ostensibly because, as Musk had told Lovallo in the conference call, “the media tends to read all sorts of nonsense into deliveries.”

Tesla is new to the car business, and many of its on-line boosters apparently as well. With a little experience, one would be aware that data for im- and exports, and for car registrations can be obtained from service providers.

In the same conference call, Lovallo asked Musk:

“How do you get comfortable with selling vehicles to resellers in China that presumably don’t have your best interest in mind or promoting the brand?”

Musk’s answer:

“We’re not really selling to resellers anywhere in the world. So it may be possible that someone’s claiming that they’re a reseller of Tesla, this is a false claim.”

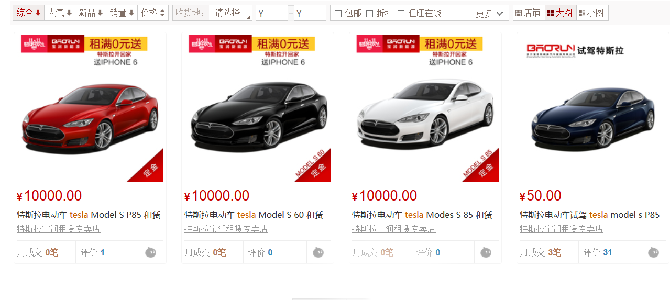

Not true. According to China Daily, a new policy, in effect since August 1 2014, “creates enormous opportunities for car dealers by freeing them up to sell any brand of imported car.” Also, grey imports advance from a shady business to full legal standing as China is adapting the freewheeling EU dealer model. Anyone who has a Tesla available for sale in China can call himself a reseller. Lovallo pointed out that Teslas were available on-line at T-Mall, and that the “first two rows of cars were actually all resellers or listed as resellers as least.”

Musk grandiosely promised that Tesla “will make sure that is removed.” The cars are still on T-Mall, and you get a free iPhone 6 when signing a $1,600 monthly lease.

A few weeks after the conference call, and a week after the DailyKanban article about the huge discrepancy about the shipped and registered Model S, Veronica Wu, Tesla’s China president and the architect of the fleet sales strategy, was fired. The cancellations happened during her watch. U.S. HQ upped the first deposit to 50.000 yuan ($8,100), while leaving the second deposit unchanged. According to Carnewschina, “the higher deposit caused an immediate drop in sales in late 2014 as potential buyers considered 50.000 yuan as far too much.”

The date of Wu’s sacking, December 12 2014, would have been an opportune time again to address the fact that unsold Model S are piling up in Tesla warehouses, but again, nothing happened. Tesla China was pretty much incommunicado at the time, also because our erstwhile penpal and Tesla spokesperson Peggy Yang had been disposed of along with Veronica Wu. Yang was Sproule’s first hire after he signed-on at Tesla, and she knew the car business from Volkswagen, facts that made her suspect.

Model S were piling up in Chinese warehouses, but at a February 12 conference call with analysts, Elon Musk still maintained that Tesla can’t make cars fast enough:

“It’s not like there were all these extra cars we could have produced, and if only we had a bunch more customers in China, we could have set (inaudible) some of those cars. We had — we were production constrained. I wish we weren’t, but we were. We look forward to getting demand constrained in the future.”

By February, thousands of Chinese customers/scalpers/arbitrageurs apparently had refused to take delivery of their cars, but Elon Musk insisted that the biggest issue is Chinese who think charging is hard, and that it’s the fault of Tesla’s brain-dead salespeople:

“The biggest issue, which we are still fighting to address, is the perception that it is difficult to charge your car in China. This is false. It is not difficult to charge your car in China. Unfortunately, this sounds brain-dead, but our sales team was telling people that it was difficult to charge in China, even though this is not true. That is pretty silly.”

The sales team wasn’t brain-dead, it was doing its job. As per company policy, the team told prospective customers that a car would only be sold if there is a fixed parking spot where a charger is installed. I lived in China for eight years, some of them in a fancy penthouse in Beijing’s glitzy Central Business District. I had a parking spot in the basement garage. It wasn’t fixed, and the building management would not have allowed a charger. Occasionally, the fuses popped upstairs. Charging problems in China are well documented, and it is “pretty silly” or, your choice, downright arrogant for an accidental short-term tourist to China to claim otherwise.

“I don’t think there is some unique missing issue in China,” Musk said during the February conference call.

A month later, he had to admit to Xinhua that there is “a speculation hangover.” Nearly half of the cars shipped to China in 2014 have not hit the road. The bottom fell out of the reseller/scalper/arbitrageur business. New Model S can be had at steep discounts for immediate delivery at resellers. They compete with new Model S available for immediate delivery and at steep discounts at Tesla’s official stores in China. Any car blogger knows that fleet sales are poison for resale, and the poison is killing Tesla in China.

Last May, the DailyKanban predicted that Tesla would not make its target of selling 5,000 cars in China in 2014. We did that after receiving Peggy Yang’s letter in which she outlined that Teslas would only be sold to customers if there is a Tesla tech center in town, and only if there is a fixed parking spot with a charger installed. It now turns out that only about half of that 5,000 unit target was registered in China, and many of those were grey imports. Veronica Wu had come to the same conclusion right away, and she found a way around the self-inflicted limitations: Alleged “fleet sales” to resellers which Tesla officially does not have. When the business model of the resellers collapsed, Tesla’s China sales cratered. In the first two months of 2015, an average of 360 Model S per month was registered in China.

Tesla told Xinhua that March sales would see an uptick of 100 to 150 percent over February. February was Chinese New Year month, and registrations were down to 260. In any case, March wasn’t over when the quote was made, and by now, we have learned to treat Tesla announcements with care. If the rest of the year will be like the first quarter, Tesla will have a hard time making its 5,000 units target this year, and that’s with a large chunk of the cars already in-country.

- Short term, Tesla’s China syndrome will not improve, unless the thousands of cars sitting in Tesla warehouses, and unsold on lots of resellers/scalpers/arbitrageurs, have been digested.

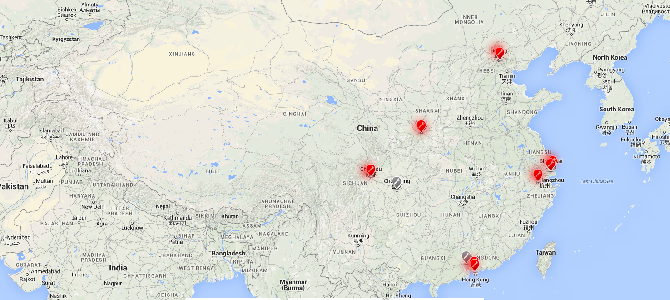

- Medium term, the situation will not improve as long as Tesla can’t sell beyond its sparsely placed tech centers. As the map above shows, two years after the start of order taking in China, orders should only be accepted in eight spots of the map, which effectively puts the Tesla Model S out of the reach of 94 percent of the Chinese population.

- Long-term, Tesla’s über-rich valuation hinges on the assumption that it will sell 500,000 cars by 2020. Doing so is impossible without a firm presence in China, the only large market with strong growth and strong growth prospects. Two out of the world’s three largest automakers, GM and Volkswagen, already have more than one third of their sales in China, and they are building factories for more. As an import, Tesla, shouldered with high tariffs and locked-out from government subsidies, Tesla can’t compete. If you are locked out of China, you are locked out of growth. Significant participation in the Chinese market is only possible with production in China, something Elon Musk belatedly has begun to realize. Musk said it will be producing in China in “three or four years,” but we have learned to treat Musk’s announcements with care, and the path to a Chinese joint venture is littered with rocks. No production in China, no 500,000 cars by 2020, it’s that simple.

A year ago, the DailyKanban asked Peggy Yang, with copy to Simon Sproule, these questions:

“At the April 22 photo-op where the first deliveries were announced, your boss allegedly said that “at some point in the next three or four years we’ll be establishing local manufacturing in China.” Chinese policy requires a joint venture partner for that, and the approval process can take years. If one talks about “three or four years,” talks with possible JV partners should be on-going already. Does Tesla have these talks? With whom?”

“Current Chinese policy demands that “new energy” vehicles made in China are made and sold under a “Chinese” brand, owned by the JV. Simon will be able to give you chapter and verse on it, and how they got the first Leafs into China by promising to make the volume sales as Venucias. What brand will Tesla use when the cars are made in China?”

An answer was never received, and I doubt that Tesla will have one for years. However, these and many other questions should be asked at the next conference call. Brokers have a fiduciary duty to their clients, especially after making lofty predictions and after setting high price targets.