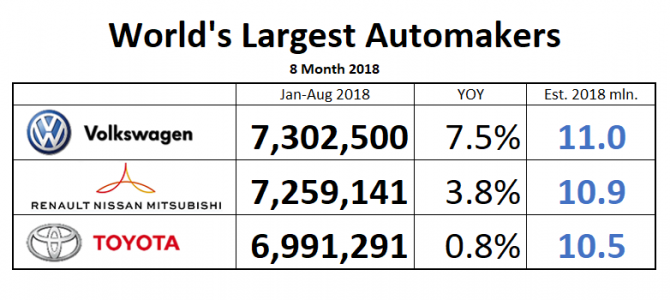

The results of the August lap of the race of the world’s biggest OEMs are in, and it’s trading places again. Volkswagen Group overtook the Renault-Nissan-Mitsubishi Alliance in the YTD rankings. Don’t get used to it: Next year, and possibly in all of Q4, Volkswagen could be edged-out by the Franco-Japanese car-conglomerate.

Volkswagen Group took the lead mainly due to a massive sales push in Europe, where deliveries rose a massive 21% in a month that usually isn’t prime selling season in the Old Country. Reason for the sudden jump: Volkswagen, along with many other OEMs, pushed anything with 4 wheels into the market before the Worldwide Harmonised Light Vehicle Test Procedure (WLTP) came into effect on September 1. A good chunk of these cars, while “registered,” is likely sitting somewhere “unsold.” See note below.

Matthias Schmidt, who edits the Automotive Industry Data newsletter out of Berlin, predicts that the rankings may change in the last quarter of the year as the pulled-forward (alleged) sales will be missed. Volkswagen dominates the EU with a 25.1% YTD market share (up from 23.6% in the same period of the previous year, dire predictions of dieselgate-disaster notwithstanding) and will hence be hardest-hit by the WLTP-effect. In Volkswagen Group’s largest market China (yes, China buys more VW Group cars than the EU) sales were slightly down in August, and up 6.7% for the year.

Second-placed Alliance also received a WLTP jolt, with Renault up 57.8% , and Nissan up 44.7 % in August in the EU. January-August, Renault registered 11.5% more units worldwide, while Nissan is still 4.5% below last year. Mitsubishi Motors continues to be the percentage star of the Alliance with its January-August production up nearly 21%. The Alliance is only some 43,000 units behind Volkswagen, and with that thin a lead, anything can and will happen.

Meanwhile, Toyota has settled into the #3 spot, and is increasingly unlikely to become a factor at the very top. While Volkswagen just opened four new factories in China, Toyota is more worried about being caught with excess capacity when the Big Slump arrives.

Note: This analysis attempts to track production, not sales, because this is how the world automaker umbrella organization OICA ranks automakers.

Due to the different methodologies of their measurement, “sales” numbers have proven to be unreliable, and prone to ‘sales reporting abuses,” as recent scandals in the U.S., along with rampant “self-registrations” in the EU have shown.

At the same time, data reported by automakers are becoming increasingly hard to compare.

Toyota reports production only. Volkswagen reports “deliveries” to wholesale – which is, at least for this exercise, close enough to production. The Alliance numbers are a blend of production data reported by Nissan and Mitsubishi, and deliveries reported by Renault.