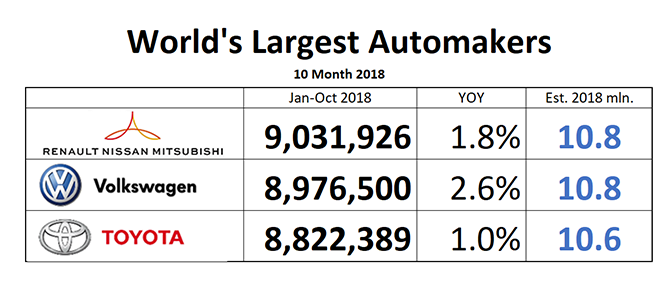

Maybe this will brighten the otherwise bleak day of deposed Renault-Nissan-Mitsubishi Alliance Chairman Carlos Ghosn, who still languishes in an inhospitable Tokyo jail: With him still in charge, the Alliance edged-out a similarly scandal-plagued Volkswagen Group, and became World’s Largest Automaker in October. The two are only 55K units apart, and with the counting methodologies increasingly shaky (see below) it is very likely that both the fraught French-Japanese Alliance and the Germans will declare themselves winners when the year is over.

Volkswagen is still hurting from the effects of the new WLTP test cycle which was introduced in Europe in September. Prior to that, Automakers attempted to register (but not necessarily sell) any non-compliant car, and the front-loading caused a significant hangover in Europe. As Europe’s largest automaker, Volkswagen Group naturally is affected the most. China previously was a bigger market for Volkswagen than Europe, but no more: Volkswagen hurts from China’s suddenly soft car market.

At the Alliance, the situation remains unchanged: Nissan’s output is down nearly 5%, Renault is up 6%, while the Alliance’s new darling Mitsubishi Motors is ahead nearly 21%.

The bottom line winner of the race probably will be 3rd placed Toyota Group. It refused to add significant capacity, and it goes into a more than certain cyclical downturn with its factories running at full tilt.

And now the necessary caveat:

The race for World’s Largest Automaker is not decided by sales, but by production, and this analysis attempts to track production, not sales, because this is how the world automaker umbrella organization OICA ranks automakers.

Due to the different methodologies of their measurement, “sales” numbers have proven to be unreliable, and prone to ‘sales reporting abuses,” as recent scandals in the U.S., along with rampant “self-registrations” in the EU have shown. The WLTP story underscores this point: Neither the explosion of EU registrations in July and August, nor the sudden implosion in September and October truly reflect actual sales in Europe.

At the same time, data reported by automakers are becoming increasingly hard to compare.

Toyota reports production and sales. Volkswagen reports “deliveries” to wholesale – which can be cars dumped on dealer lots, or actual sales to customers. The Alliance numbers used to be a blend of production data reported by Nissan and Mitsubishi, and deliveries reported by Renault. As of September, Renault started to report sales only, forcing us to use those.

With results that close, every unit counts, and with different ways of counting, the matter is becoming a bit silly.