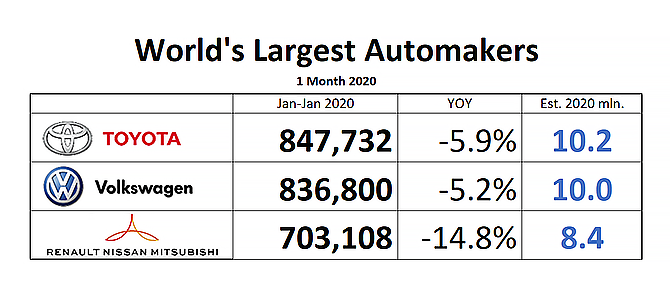

The 2020 round of World’s Largest Automakers starts at an ominous note. Toyota is back in #1, but it begun the year with its global production down nearly 6% compared to January 2019. Expect this trend to continue as long as the world, and especially Asia, is in the grips of the virus.

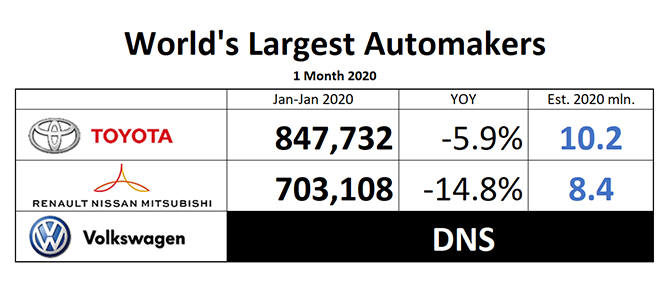

Last year’s #1 Volkswagen Group decided to stay away from the race, but then it didn’t. Four weeks ago, the company let the media know that “the Volkswagen Group is focused more than ever on profitability,” and that “unit sales are no longer as important as in the past” (when Volkswagen made becoming world’s largest automaker its leitmotif.) Doing so, Volkswagen joined the ranks of GM, Ford, and Tesla, and it ominously decided to stop publishing monthly global deliveries data. The company previously dedicated at least one full-time spokesperson to the publishing of sales data, but as promised, there was no press release for January.

In a previous version of this story, we had already dumped Volkswagen into the dustbin of unit statistics with an ominous “DNS” (did not start, see left) to its logo. Then car counter extraordinaire Matthias Schmidt (buy his data at http://schmidtmatthias.de/online-store) found Volkswagen Group January stats in a dark&dusty corner of the Internet. Apparently, Volkswagen’s Investor Relations did not receive the memo of the PR department. VW’s Konzernkommunikation should be thankful to Matthias for having been spared the discomfiture. Should VW’s IR stop publishing monthly numbers also, the Dailyanban won’t hesitate one bit in DQing VW.

The Renault-Nissan-Mitsubishi Alliance is down a hard 14.8%, brought down by sicklish Nissan, which started the year with its output down nearly 19%, while the other two Alliance members hovered around the 10% mark. Nissan‘s January production was down nearly 25% in China, and more than 28% in the U.S.

The worst is yet to come. Volkswagen wisely is maintaining a low profile, given the fact that around 40% of its global sales are in China, where total February auto sales are expected to be down by around 80%. At Nissan, approximately one fifth of its output goes to China. Toyota is much less exposed to China.

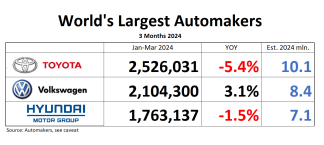

And now the necessary caveats:

The race for World’s Largest Automaker is not decided by sales, but by production, and this analysis attempts to track production, not sales, because this is how the world automaker umbrella organization OICA ranks automakers.

Due to the different methodologies of their measurement, “sales” numbers have proven to be unreliable, and are prone to ‘sales reporting abuses,” as recent scandals in the U.S., along with rampant “self-registrations” in the EU have shown. OICA doesn’t rank automakers by sales for a reason, and if you ask for sales data, you’ll hear a terse “the OICA secretariat does not have any further data.”

At the same time, data reported by automakers are becoming increasingly hard to compare.

Toyota reports production and sales. Volkswagen report(ed) “deliveries” to wholesale – which can be cars dumped on dealer lots, or actual sales to customers. The Alliance numbers used to be a blend of production data reported by Nissan and Mitsubishi, and deliveries reported by Renault. As of September 2018, Renault started to report sales only, forcing us to use those. Like so many things at the Alliance, its data are a mess.