The virus hit global auto makers brutally hard in April. No OEM, no market was spared. Global deliveries by all brands were nearly cut in half. In India, and in 30 other countries of the world, not a single car was reported as registered in April. Former volume markets like Italy and France were down 97% and 88% respectively. Year-to-date, global total industry volume is down nearly 30%.

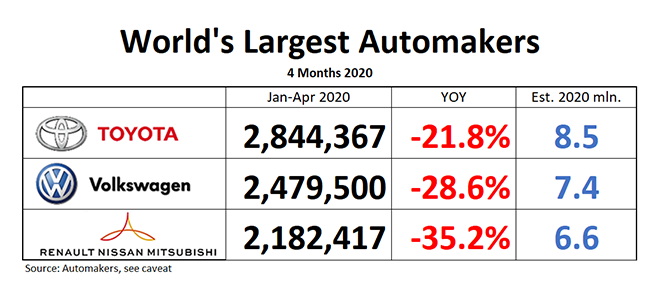

Yet, one OEM continues to be more resilient than its peers, and that is Toyota Group. Down “only” 21.8% YOY in the first four months, Toyota extended its lead over #2 Volkswagen, which suffered a 28.6% reduction in the same period. With one third of the year behind us, Toyota leads Volkswagen by some 365,000 units. Catching up will prove quite tough for VW.

April was grim for world’s leading automakers, with the virus eating more than half of their usual output.

Toyota Group’s worldwide production was down 51.1% in April.

Volkswagen Group’s global deliveries also were cut nearly in half, with a 45.5% loss YOY in April. South America (-77.6%) Western Europe (-76.7%) and Middle East/Africa (-73.7%) were hit hardest. China saved the month with a 1% increase over April 2019. Year-to-date, Volkswagen Group’s Western Europe deliveries are down 34.4%, most other markets are down in the low- to mid 20%.

Hardest-hit of the top three is the Renault-Nissan-Mitsubishi Alliance. It already had suffered from volume-consumption many months before, and the virus made the pre-existing condition worse.

Nissan’s output dropped 62.4% in April, while Renault’s deliveries dropped 69.7%, and Mitsubishi’s production sunk by 66.2%. The ugly bottom line for April: Alliance down 65%, and down 35.2% for the first four months of the year.

And now the necessary caveats:

The race for World’s Largest Automaker is not decided by sales, but by production, and this analysis attempts to track production, not sales, because this is how the world automaker umbrella organization OICA ranks automakers.

Due to the different methodologies of their measurement, “sales” numbers have proven to be unreliable, and are prone to ‘sales reporting abuses,” as recent scandals in the U.S., along with rampant “self-registrations” in the EU have shown. OICA doesn’t rank automakers by sales for a reason, and if you ask for sales data, you’ll hear a terse “the OICA secretariat does not have any further data.”

At the same time, data reported by automakers are becoming increasingly hard to compare.

Toyota reports production and sales. Volkswagen reports “deliveries” to wholesale – which can be cars dumped on dealer lots, or actual sales to customers. Volkswagen also makes the numbers very hard to find. The Alliance numbers used to be a blend of production data reported by Nissan and Mitsubishi, and deliveries reported by Renault. As of September 2018, Renault started to report sales only, forcing us to use those. Like so many things at the Alliance, its data are a mess.