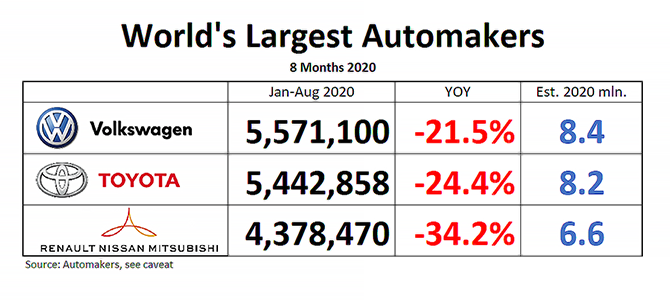

Eight months into this wretched year, global automakers are recovering ever so slightly, and Volkswagen Group is extending its lead over its Japanese nemesis Toyota ever so slightly as well. Year-to-date, Volkswagen’s global deliveries are down “only” 21.5%, an improvement over last month’s 23.6% YTD delta. Toyota is recovering “faster than expected,” the company says, but at 24.4% below last year’s YTD number, Toyota is rebounding at a slightly slower pace than Volkswagen.

The performance of both companies reflects global total YTD industry volume of passenger vehicles, which was down 22.8% in August. Volkswagen is getting a boost from its by far largest market China, which is convalescing much faster than other major markets. Volkswagen’s China deliveries were up 3% in August. Toyota (incl. Lexus) could improve its August China sales by an impressive 26%, but Toyota’s China exposure is much lower than Volkswagen’s.

3rd-ranked Renault-Nissan-Mitsubishi Alliance is a whole other story. Renault, down 29.2%, can be counted among the walking wounded. Nissan however is down 36.2%, and the former performance darling Mitsubishi Motors reports a 40.7% cut of its former self. Both should be counted as ICU cases, underlined by the fact that the Japanese government underwrote a $1.7 bln loan to what the Nikkei calls a “troubled automaker.” COVID is all but throwing a grey blanket over the Alliance’s pre-existing health conditions, and the tumor sits in Yokohama.

Can’t help it dept.

By year’s end, the world’s top three automakers together will make in the neighborhood of 23 million units. Tesla, the world’s most hyped automaker, will make around half a million units. The silly stock market values Tesla at $392 billion, that’s $90 billion more than the world’s top three automakers taken together.

And now the necessary caveats:

The race for World’s Largest Automaker is not decided by sales, but by production, and this analysis attempts to track production, not sales, because this is how the world automaker umbrella organization OICA ranks automakers.

Due to the different methodologies of their measurement, “sales” numbers have proven to be unreliable, and are prone to ‘sales reporting abuses,” as recent scandals in the U.S., along with rampant “self-registrations” in the EU have shown. OICA doesn’t rank automakers by sales for a reason, and if you ask for sales data, you’ll hear a terse “the OICA secretariat does not have any further data.”

At the same time, data reported by automakers are becoming increasingly hard to compare.

Toyota reports production and sales. Volkswagen reports “deliveries” to wholesale – which can be cars dumped on dealer lots, or actual sales to customers. Volkswagen also makes the numbers very hard to find. The Alliance numbers used to be a blend of production data reported by Nissan and Mitsubishi, and deliveries reported by Renault. As of September 2018, Renault started to report sales only, forcing us to use those. Nissan makes matters worse by insisting on reporting its data on a fiscal year (April through Mach) basis only. Like so many things at the Alliance, its data are a mess.