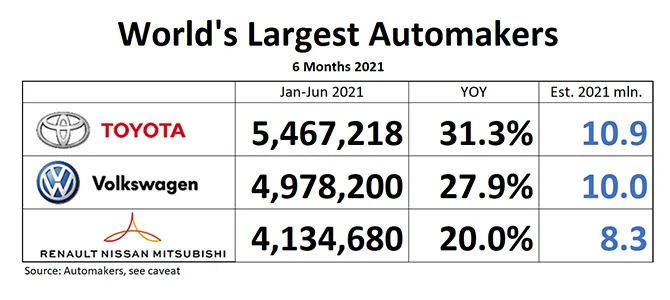

Six months into the year, Toyota Group firmly established its leading position in the race for World’s Largest Automaker 2021. Global sales of Toyota Group companies were nearly half a million ahead of its arch nemesis Volkswagen. Unless an even bigger catastrophe happens, the year should end with Toyota crowned World’s Largest Automaker. If current trajectories are maintained, Toyota could lead VW by a million at year’s end.

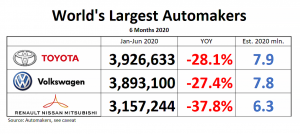

Don’t be overly impressed by the double-digit growth rates. A year ago (see insert,) global OEMs were down by slightly higher double digits as the virus closed factories and dealerships the world around. Despite the impressive percentages, we are far from previous peaks.

This year, a lack of chips is the new COVID. Toyota so far managed the silicon-shortage best by establishing strategic chip reserves. Stockpiling semiconductors only goes so far, and recently, Toyota had to announce what they euphemistically call “adjustments to production” due to missing parts.

Perennial laggard Renault-Nissan-Mitsubishi Alliance continues to lag. Nissan, up 21.5% is showing signs of life while Renault (+18.7%) and Mitsubishi Motors (+17%) drag down the fraught Franco-Nipponese group. Imagine, a few years ago, when Carlos Ghosn was in charge instead on the lam in Lebanon, the Alliance was World’s Largest Automaker at this time of the year.

And now for the usual disclaimer: Daily Kanban is now ranking global automakers by sales. We used to rank them by production, because this was how the global automaker umbrella association OICA had done it in the past. OICA seems to have thrown-in the towel, and you no longer will find any recent automaker rankings on the previously authoritative OICA website, neither by production, nor by sales. Reliable production data are harder and harder to come by, forcing us to switch to sales/delivery data published by automakers. Be aware that “deliveries” can be a rather elastic term. Deliveries can be sales to end users, or cars dumped on dealer lots, or cars “delivered” to sales organizations, or combinations thereof.

Also, please note that Mitsubishi Motors does not publish global sales, only domestic sales in Japan. For that reason, we are forced to use Mitsubishi’s published global production data as a proxy. Speaking of the Alliance, their number reporting is not allied at all, and a common picture requires considerable Excel machinations. Nissan and Mitsubishi report sales and production, Renault only reports deliveries. Mitsubishi does not report global sales, Nissan does.