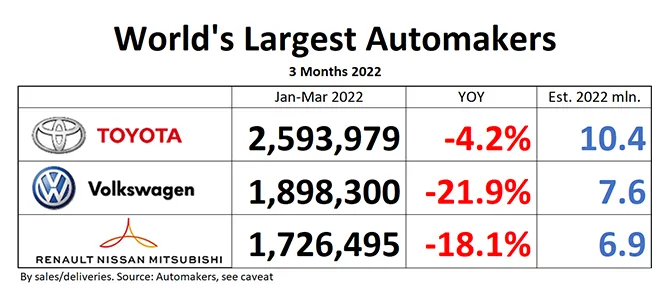

A global crisis is the true test of leadership. By the end of the first quarter, Toyota Group leads the ranking of World’s largest automakers down only 4% compared with the same period in the prior year, while its 2nd and 3rd ranked peers are down in the double digits. World’s automakers are trying to navigate a confluence of disasters, pestilence, parts shortages, ports jammed with container ships, Chinese megacities in lockdown, a shooting war in Europe, earthquakes, suppliers in flames – if it would rain frogs and fishes, we’d just shrug – and Toyota keeps a steady course. If you could peel your mind away for a second from the soap opera starring Musk and Twitter, please give a nod to Toyota, they really deserve it.

Volkswagen’s numbers look bad. In its largest market China, Q1 sales were down 24%, Central and Eastern Europe (-31%) and South America (-42%) look even worse. At the coming-apart Alliance, Renault is down17%, Nissan 21%. Compared to that, stepchild Mitsubishi Motors looks downright healthy with its output down only 8%.

The results of Volkswagen and the Alliance are especially striking considering that total global industry volume was down “only” 6% in Q1, meaning that Toyota outperformed the market, while Volkswagen and the Alliance severely underperformed.

And now for the usual disclaimer: Daily Kanban ranks world’s largest automakers by sales. We used to determine the largest automaker in the world by looking at production, because this was how the global automaker umbrella association OICA had done it in the past. OICA seems to have thrown-in the towel, and you no longer will find any recent auto manufacturer rankings on the previously authoritative OICA website, neither by production, nor by sales. Reliable production data are harder and harder to come by, forcing us to switch to sales/delivery data published by automakers. Be aware that “deliveries” can be a rather elastic term. Deliveries can be sales to end users, or cars dumped on dealer lots, or cars “delivered” to sales organizations, or combinations thereof.

Also, please note that Mitsubishi Motors does not publish global sales, only domestic sales in Japan. For that reason, we are forced to use Mitsubishi’s published global production data as a proxy. Speaking of the Alliance, their number reporting is not allied at all, and a common picture requires considerable Excel machinations. Nissan and Mitsubishi report sales and production, Renault only reports deliveries. Mitsubishi does not report global sales, Nissan does. To make the confusion complete, Nissan sometimes reports sales for the April-to-March fiscal year, and sometimes for the calendar year.