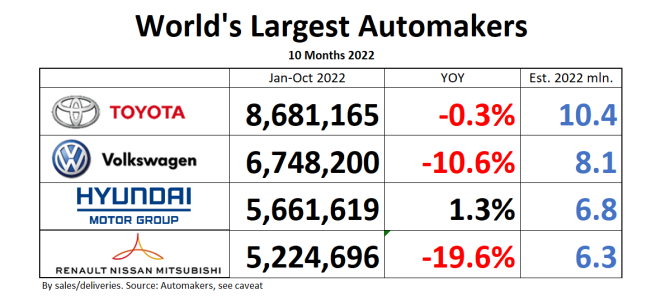

With only two more months to go on the reporting calendar, the bloodletting in the global auto market appears to be down to a trickle. Global total industry volume was down only 0.7% YOY by the end of October. Not all OEMs recover at the same pace, however.

Despite many shutdowns and dire warnings, Toyota Group’s year-to-date global sales were down just 0.3% compared to January through October 2011, and my highly unsophisticated forecast tool still projects full year sales slightly about 10 million. October levels were up compared to the same month in the previous year, as Toyota sees “solid demand, in addition to a rebound from the impact of parts supply shortages.”

The Korean competition at Hyundai Group even eked out a small gain of 1.3%.

In the not-so-healthy department, Volkswagen Group still is down some 10% YOY, but we’ve seen worse. However, Volkswagen Group suddenly stopped breaking out its BEV sales, which it proudly presented until a month ago. Maybe there’s little to be proud of?

At the bottom of the list is the deteriorating Renault-Nissan-Mitsubishi Alliance, with little signs of a rapid recovery. That’s what you get when management is busy with intramural infighting, instead of focusing on the chip & covid crisis.

And now for the usual disclaimer: Daily Kanban ranks world’s largest automakers by sales, as reported by the automaker. We used to determine the largest automaker in the world by looking at production, because this was how the global automaker umbrella association OICA had done it in the past. OICA seems to have thrown-in the towel, and you no longer will find any recent auto manufacturer rankings on the previously authoritative OICA website, neither by production, nor by sales. Reliable production data are harder and harder to come by, forcing us to switch to sales/delivery data published by automakers. Be aware that “deliveries” can be a rather elastic term. Deliveries can be sales to end users, or cars dumped on dealer lots, or cars “delivered” to sales organizations, or combinations thereof.

Also, please note that Mitsubishi Motors does not publish global sales, only domestic sales in Japan. For that reason, we are forced to use Mitsubishi’s published global production data as a proxy. Speaking of the Alliance, their number reporting is not allied at all, and a common picture requires considerable Excel machinations. Nissan and Mitsubishi report sales and production, Renault only reports deliveries. Mitsubishi does not report global sales, Nissan does. To make the confusion complete, Nissan sometimes reports sales for the April-to-March fiscal year, and sometimes for the calendar year.