You probably aren’t highly interested in car sales in Poland. If you want to understand the arcana of EU car sales, you may want to make yourself understand why Poles buy so many cars – or not. “Polish new car registrations rose 16.5 percent on the year in September,” Reuters writes. A good deal of these sales were fake, in Poland as well as all over Europe.

Sales in Europe are reported by registrations, using data captured by licensing authorities. This should make the data more reliable than, say, those of the U.S.A. or China, where sales data are reported by manufacturers, and where one never quite knows what a “sale” is – to the customer? To dealer? Fleet sales moved into a quarter where they are needed? Pure registrations, counted by government-salaried droids, should be beyond doubt. In truth, EU sales data are whackier than you dare to imagine.

A shockingly high percentage of car sales in Europe are on paper only. Cars are registered for a day. They show up in statistics as sold. They then are deregistered, and enter the “used car” statistics, which very few people track. “OEMs or dealers buy their own cars to look better on paper,” auto professor Ferdinand Dudenhoefer said five years ago, and matters got worse ever since.

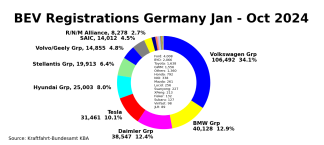

Currently, about 30 percent of all cars “sold” in Germany are registered by either the OEM, or the dealer. In August, more than half of the Chevrolets “sold” in Germany were “bought” by the OEM or the dealer, a study of the CAR Institute in Dusiburg says. Half of the Chevys reported as sold in Germany were not sold. Likewise unsold were 41 percent of the Porsches, 35 percent of the Volkswagens, 22 percent of the Mercedes and so forth in what Focus Magazin calls “the big registration lie.” There are no pan-European data on this, but it stands to reason that if 30 percent of sales are fake in stable Germany, that number must be much higher in the truly desperate countries of the EU.

What looks like a giant conspiracy of crooked OEMs actually is a confluence of several factors.

- There is the driver of all grey markets, the urge to “make your number,” to fulfill quotas.

- To this comes EU legislation that allows just about anybody to sell cars. The same laws force OEMs to extend warranty to what elsewhere would be “grey market” cars. Culled dealers can continue selling their brand, even other brands. Instead of buying inventory from the OEM, it comes from agents.

- Differences in taxes and fees from on EU country to the other provide further fuel to this undercover market. A car bought in Denmark famously can incur a 180 percent tax. VAT rates can be as low as 18 percent in Cyprus and Malta, and as high as 25 percent in Sweden or 27 percent in Hungary. According to the European Commission, “there is little EU legislation, or harmonisation of national fiscal provisions, applied by the Member States in the area of passenger car taxation. Therefore, it is for each Member State to lay down national provisions for the taxation of these cars.”

- While tax rates can be dramatically different, the EU forced OEMs to keep after tax consumer prices in a narrow range across Europe. In April 2013, the EU proudly announced that prices all over Europe have harmonized, to the extent that price tracking is no longer necessary. Enter arbitrage. Moving cars across borders inside of the EU, and using a complex system of tax refunds, a vast off-the-books market is created. In the case of Poland, about 12 percent of newly registered cars are exported out of the 23 percent VAT country. This would turn the 16.5 percent growth rate in Poland into a more benign 14.4 percent – if all the non-exported cars would actually be sold. A good deal aren’t .

Don’t expect the Daily Kanban to teach you the intricacies of making money by selling for much less than you supposedly paid – any large EU CPA firm and various specialized consultants will happily do that for a fee.

While consumers enjoy hefty discounts of 20 percent or higher, statistics become a casualty. New cars sales are used as a prime indicator for the vitality of an economy. If 30 percent of the cars “sold” in Germany are not really sold, what good are the stats?

How can we read a turn-around of the European economy into numbers that are to a large degree fake?