Ever since Sergio Marchionne offered the auto bailout team a home for a bailed-out Chrysler, his Italo-American hodgepodge has been held together with bootpolish, high hopes and strong demand for trucks and SUVs. Had the Jeep and Ram brands been spun off to any other automaker, the Fiat, Chrysler and Dodge brands would almost have certainly ended up in a bankruptcy sale. Instead the House of Chrysler’s two perennial profit centers have found themselves stuck propping up failing mass market brands, just as they were under Cerberus and Daimler-Chrysler management. In the meantime, Chrysler’s cross-town rivals have improved their cars enough to push their truck-powered profit margins towards the 10% level in North America. But despite strong growth in sales growth, volume and mix, FCA’s North American margins are “bizarrely low” according to research by Bernstein. And their research shows that the bootpolish is really starting to wear thin…

I’ve come to appreciate Bernstein’s work as some of the better-written analyst work in the business (indeed, it’s better than most of the so-called automotive journalism). The firm’s analysts don’t shy away from provocative calls or acid-edged writing, and their FCA analysis is no exception. Noting rising costs and headcount, Bernstein’s analysts point out that FCA’s official US incentive and revenue per unit levels are still on par with the competition. So where are the margins going?

The answer, of course, is “maintaining volume growth.” But there’s more to what’s going on than simply the “Black Friday” blowout partially documented by Daily Kanban. According to Bernstein’s report, FCA is resorting to a number of the sneaky tricks used by the industry to goose sales numbers, including some I hadn’t heard of before:

1. Dropping front-end margin to dealers (to lower retail price while keeping wholesale price intact) and then using BTL payments to dealers on a delayed basis to make up their lost margin;

2. Flooding dealers with excessive numbers of service loaners (inducing them to take them with BTL loaner bonuses), which are first booked as new-car sales and then flushed into the used-car market with as little as 5 miles on the odometer – for example see: http://www.parkwaychrysler.com/usedinventory/

index.htm?year=2015&&&&

3. Offering the rental fleets cars on a “program” basis (that is, with a guaranteed buy-back price in future years), which they had sworn off before, which boosts volume without price cutting as the rental company’s TCO is reduced;

4. Working with insurance companies to offer Chrysler products to insureds who have suffered a total loss in a crash and need a new car, with the discount flowing through a special promotional category;

5. Flogging Chrysler hard in Canada, since incentives there don’t show up in the US incentives that everyone tracks (we believe Chrysler fleet mix in Canada is very high);

6. Selling to lower-quality credit customers – to quote Jessica Caldwell, senior analyst for Edmunds.com, “the company has been willing to provide car loans and leases to people with subprime, or risky credit scores. In November 2014 about 22% of Dodge cars and trucks were financed at an interest rate of 10% or higher. The Chrysler and Fiat brands also have a higher percentage of customers financing their purchases with high interest loans than the overall industry. What that tells me is they are definitely attracting a customer with less than stellar credit rating, and nobody wants to be doing this volume of business in this space over the long term.”

Today Automotive News confirmed that FCA is pushing up invoice prices on dealers, taking one percent of their margin as it grasps vainly for the kind of numbers analysts expect from automakers at the top of their cycle. After all, as the Bernstein report notes, the US market is at the top of its cycle.

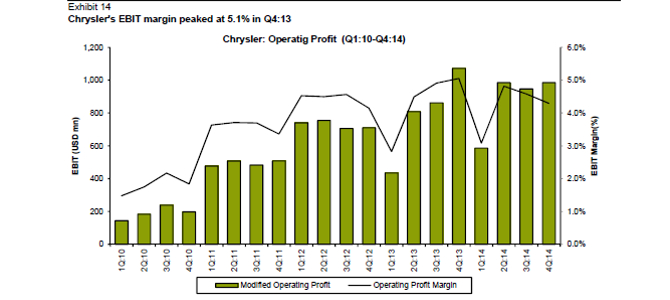

If Chrysler can only make 4% margins in the good times (3% in real terms, once R&D is expensed, remember), then it’s probably going to lose money again in tougher times. Chrysler’s over-the-cycle margins do not look very encouraging – or valuable to a buyer. We find it hard to see the bull case for FCA when its main engine appears to have such limited earnings power. Marchionne is looking for an M&A solution for FCA for a reason. The problem is we don’t think any partners want to join hands.

If Chrysler’s quality problems keep burning customers and its margin-seeking keeps burning dealers, FCA won’t stay together long enough to merge with anyone. But then, the only way anyone will do a deal with FCA is if they only get the assets that are worth having, namely Ram and Jeep. And the best way to get those is if FCA goes bankrupt. The car business is tricky enough without trying to keep marginal, loss-making brands alive.