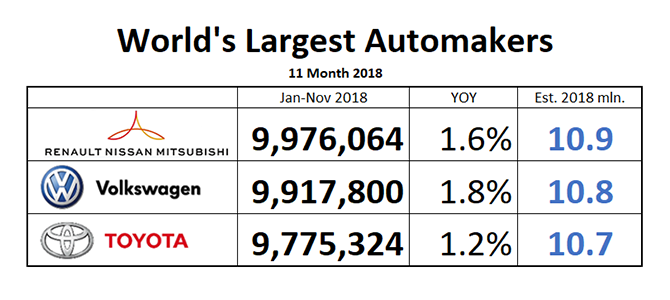

Two of the world’s most scandal-ridden carmakers also are the world’s largest. With only one month left to go, the race for World’s Largest Automakers 2018 has the Renault-Nissan-Mitsubishi Alliance in the lead while its chairman Carlos Ghosn sits in a Japanese jail. The Alliance is closely followed by a Volkswagen Group still reeling from its dieselgate scandal. Customers don’t seem to care, and they still buy the cars with unmitigated abandon.

The Alliance and Volkswagen are less than 60,000 units apart, and with a little end-of-the-year push, Volkswagen could easily edge out the Alliance. The French-Japanese car-conglomerate keeps being held back by a sub-par performance of Nissan, which so far has produced 4.4% fewer cars than January-November 2017. Mitsubishi Motors keeps shining as best performer of the group with an output nearly 21% larger than in the same period last year. Renault added nearly 5% to its prior-year output.

Volkswagen is held back by recent weakness in its two biggest markets Europe and China. November deliveries in Europe were down 3%, in China a whopping 7.3%.

While the race remains undecided that late in the year, the #3 is clear. Toyota has happily stepped aside to let Volkswagen and the Alliance duke it out. Toyota refrained from adding significant capacity and it is going into the big cyclical downturn much leaner than its competitors. Also, no scandals.

And now the necessary caveat:

The race for World’s Largest Automaker is not decided by sales, but by production, and this analysis attempts to track production, not sales, because this is how the world automaker umbrella organization OICA ranks automakers.

Due to the different methodologies of their measurement, “sales” numbers have proven to be unreliable, and prone to ‘sales reporting abuses,” as recent scandals in the U.S., along with rampant “self-registrations” in the EU have shown. The WLTP story underscores this point: Neither the explosion of EU registrations in July and August, nor the sudden implosion in September and October truly reflect actual sales in Europe.

At the same time, data reported by automakers are becoming increasingly hard to compare.

Toyota reports production and sales. Volkswagen reports “deliveries” to wholesale – which can be cars dumped on dealer lots, or actual sales to customers. The Alliance numbers used to be a blend of production data reported by Nissan and Mitsubishi, and deliveries reported by Renault. As of September, Renault started to report sales only, forcing us to use those.

With results that close, every unit counts, and with different ways of counting, the matter is becoming a bit silly.