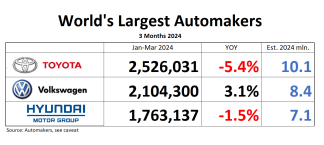

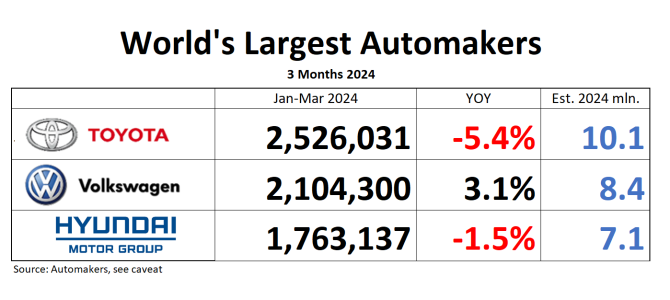

Mixed Q1 for world’s largest automakers. Sure, Toyota’s “sales hit records” says Bloomberg. But that was for the fiscal ending March 31, when Toyota Group sold a record 11.1 million units. In the first quarter of the calendar year however, and hence the last quarter of the fiscal, Toyota’s global group sales dropped 5.4% YOY, dragged down by a surprisingly weak March in the Japanese home market, and a stop of production at mini-car brand Daihatsu.

Across the Sea of Japan, Hyundai Group also was down a slight 1,5% for the quarter, also mainly due to a weak domestic market.

Volkswagen Group surprised with a 3.1% sales increase in the first quarter. “Surprised,” because aggressive cost saving programs and never-ending dire projections would make you expect anything else than increases.

Don’t rejoice, Tesla fans: Lumpy as it may be, the big disruption still isn’t happening. Remember, Tesla sales dropped 8.5% in the first quarter.

Other contenders: What used to be the Renault-Nissan-Mitsubishi Alliance came in some 30,000 units behind 3rd-ranked Hyundai. Does that make them worth following as a possible Top 3 contender? You decide: The “Alliance” has long ceased acting like a Group of companies. Cross-shareholdings and voting rights are down to 15%. Joint purchasing, usually the last thread that ties automakers together, was abandoned in September last year. The erstwhile Alliance has long stopped publishing joint numbers.

How about Stellantis? The French-Italian-American-German amalgamate landed some 400,000 units behind Hyundai in a disappointing first quarter. We better get used to the Top 3 being Toyota, Volkswagen, and Hyundai.