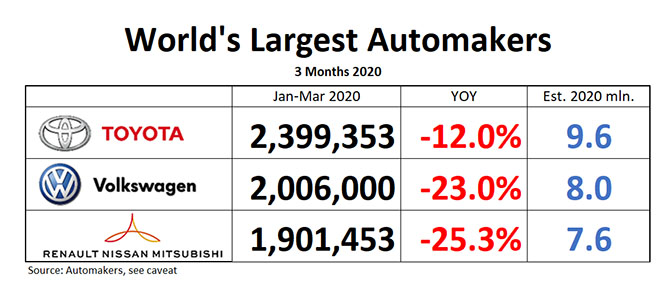

Q1 outputs of World’s Largest Automakers are in, and it is a bloodbath. Even if the full impact of the pandemic on auto sales was felt only as late as March (see below,) World’s Largest Automakers already look a whole lot smaller.

Of the three leading automotive groups, good for more than one third of the global auto market, Toyota suffered the least, down “only” 12% for the quarter year-on-year, extending its lead over 2nd-placed Volkswagen to nearly 400,000 units. That big a gap so early in the year will be awfully hard to close.

Volkswagen Group deliveries are down a whopping 23% for the quarter. Obviously, the losses were biggest in Volkswagen’s über-important China market, where deliveries were down 35% in the first quarter. You will be hard pressed to find news of the dismal showing, because Volkswagen hides the data in a very dark corner of the Internet.

Worst-hit of the three is the Renault-Nissan-Mitsubishi Alliance, for a variety of reasons. Its largest member Nissan suffers from a comorbidity after it performed a near-hara-kiri by having its Chairman Carlos Ghosn arrested (he recently fled to Lebanon.) The self-decapitation, and the following purge of management ranks, were a huge distraction, and it keeps distracting. Also, Nissan is very much exposed to China. Suchly weakened, Nissan took the full brunt of the virus. Its Q1 output was down nearly 30% YOY. Renault, down nearly 26% YOY, did not fare much better. Junior-partner Mitsubishi is down only 9%, and in an awful quarter like that, this counts as growth.

One look at the March data shows that the worst is yet to come:

March was the first month of the year when the virus turned from a China story into a global problem, even if beaches were still packed with spring breakers with everything else in mind than social distancing. In the month of March, the world’s three largest OEMs shed 31.3% of their aggregate output. Toyota, down 17.6% in March, suffered the least, and the Alliance, down 31,3%, was hit hardest as expected.

March was the first month of the year when the virus turned from a China story into a global problem, even if beaches were still packed with spring breakers with everything else in mind than social distancing. In the month of March, the world’s three largest OEMs shed 31.3% of their aggregate output. Toyota, down 17.6% in March, suffered the least, and the Alliance, down 31,3%, was hit hardest as expected.

With that in mind, the second quarter of the year can be expected to be worse than the first. Reuters said than Nissan will reduce its May output in Japan by 78%. Reuters has seen documents saying that the company plans to manufacture only 13,400 vehicles in its Japanese factories next month. In May last year, nearly 61,000 units were made. Both Volkswagen and Nissan already took down their outlooks for 2020. We will see what Toyota has to say at its quarterly results conference on May 12th. According to the automaker, “considering the current situation with COVID-19, the press briefing will be held only virtually (online) this time to secure everyone’s health and safety. “

And now the necessary caveats:

The race for World’s Largest Automaker is not decided by sales, but by production, and this analysis attempts to track production, not sales, because this is how the world automaker umbrella organization OICA ranks automakers.

Due to the different methodologies of their measurement, “sales” numbers have proven to be unreliable, and are prone to ‘sales reporting abuses,” as recent scandals in the U.S., along with rampant “self-registrations” in the EU have shown. OICA doesn’t rank automakers by sales for a reason, and if you ask for sales data, you’ll hear a terse “the OICA secretariat does not have any further data.”

At the same time, data reported by automakers are becoming increasingly hard to compare.

Toyota reports production and sales. Volkswagen report(ed) “deliveries” to wholesale – which can be cars dumped on dealer lots, or actual sales to customers. The Alliance numbers used to be a blend of production data reported by Nissan and Mitsubishi, and deliveries reported by Renault. As of September 2018, Renault started to report sales only, forcing us to use those. Like so many things at the Alliance, its data are a mess.