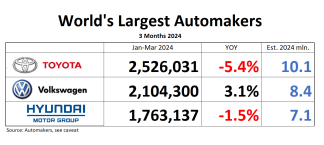

The world’s largest automaker Toyota has handed in February numbers. February is down 5.1 percent to 806,855 units. Jan/Feb is down 4.1 percent to 1,634,912 units. Peers Honda and Nissan are down more. Volkswagen is uncharacteristically late in handing in group level February numbers. From looking at Volkswagen Passenger Car deliveries, one may assume that Volkswagen needs to scrounge every unit they can find. The auto market isn’t what it used to be.

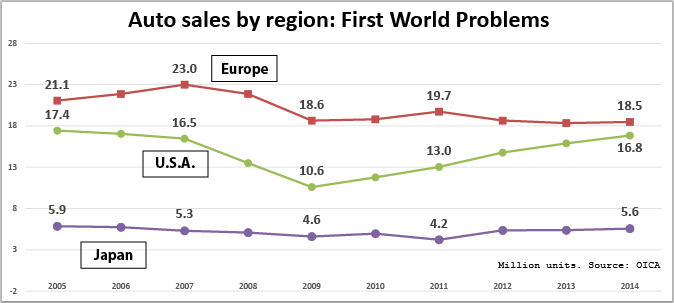

As indicated in Auto Industry 101, the global auto market has been flattish for the past 10 years. Living in America, one may think that the market is booming. It is not. It is simply bouncing back from carmageddon. As a matter of fact, it is back where it was 10 year ago. And now, there are more and more voices thinking that the U.S. market has plateaued. Says Barclay’s analyst Andrew X. Smith:

“Our forecast for headline sales to decline 1.6% y/y in March would represent only the 6th monthly y/y headline decline since late 2009 – serving as yet another reminder that U.S. light vehicle sales have reached a plateau, with little-to-no growth ahead. Admittedly, it is possible that a strong close to the month could drive March SAAR to 17.0mn. Yet, with comps only getting tougher, y/y headline changes will increasingly be flattish – albeit, with occasional outlier prints (exceedingly strong or weak). We reiterate our outlook for U.S. sales to remain plateaued in a range of 16.5-17.0mn over the next 3-4 years.”

In a no-growth environment, keeping capex under control is key to financial health. It looks like Toyota has made the right call when it put a halt on new factories through 2016. Tomorrow, I will go to Nagoya and Toyota City all day to hear first decent details on TNGA, Toyota’s New Global Architecture. I expect it to be more than just another modular kit. Current indicators point to a revirement of Toyota’s complete production system, with the impetus on getting more out of existing resources. Look for headlines via Twitter @BertelSchmitt, the write-up will have to wait until I am back from Nagoya late in the evening. I might do it on Friday.