It’s the new year, so let’s have a look back at the Fatherland I abandoned some 40 years ago, and let’s do that with a heavy emphasis on electric cars. Why? Germany is Europe’s largest car market, Germany is home of world’s second-largest automaker, and it is where Elon Musk built his second overseas factory, in bucolic Grünheide near (but not in) Berlin.

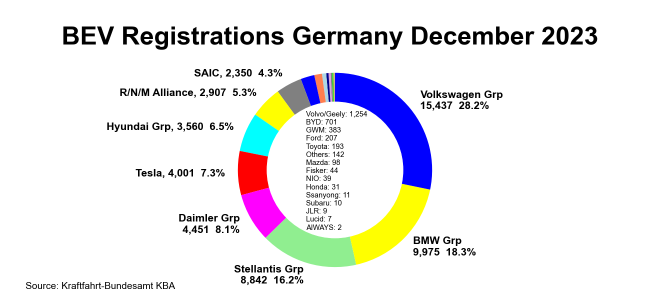

A look at the chart above shows us that Tesla isn’t doing so well in the Fatherland. These are the numbers for December, last month of the quarter and last month of the year, when Tesla usually pulls all-nighters to ship anything that is not nailed down. Not this time.

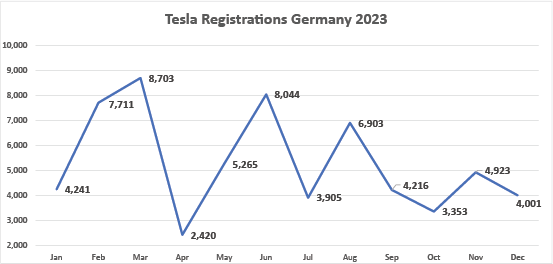

This chart of monthly new Tesla registrations is even more worrisome. It starts with the usual wild quarterly gyrations. In the second half of the year, the air is going out – and it’s not for a lack of pumping. Like in most parts of the world, German Teslas are heavily discounted, for up to 20,000 Euro less.

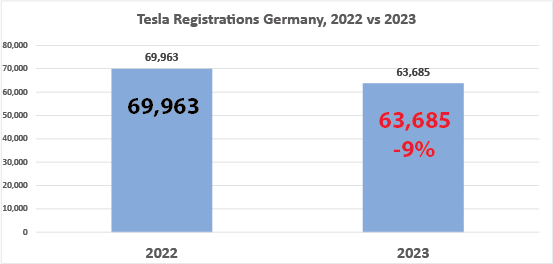

Usually, one sacrifices some margin to make it up with volume. Not this time. In 2023, Tesla’s German new car registrations came in 9% below 2022.

But maybe it’s the German car market, and maybe Germans are tired of battery-operated vehicles. Not really. Last summer, BEV sales were red hot in Germany as buyers wanted to lock-in expiring subsidies. In August, every 3rd newly registered car was a BEV. Tesla already looked a bit wobbly, as it underperformed the boiling market. As usual when subsidies expire, sales crashed. But in the months thereafter, BEV sales steadily recovered. Except at Tesla.

Elon Musk has put in the paperwork for an aggressive expansion of the Grünheide factory. It sounds like less and less of a good idea. The capacity of the current factory already is heavily underutilized, so why add more idle capacity?

(All data courtesy of Kraftfahrt Bundesamt. hard registrations.)