Sure, you can wait for Tesla’s, official production releases, but wouldn’t you be a better investor if armed with the knowledge of how many Model 3 Tesla really intends to build within the next few months? The tracking of VIN numbers has turned out to be a bit inexact. You want something where Tesla has a little more skin in the game. Clients of JL Warren Capital have that information. The company tracks a surefire leading indicator, and that is the central display screen of the Model 3. According to JL Warren’s chief analyst Jungheng Li, Tesla seems to be gearing up for a weekly production rate of 3,400 Model 3 for this quarter. If everything goes well.

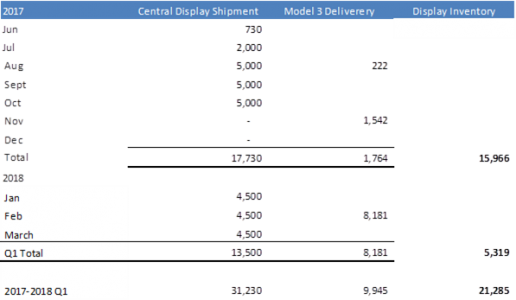

JL Warren tracks the shipment of Model 3 displays from China to their port of entry in the U.S. Those shipments are not quite just-in-time delivery. In summer of last year, a gung-ho Tesla received 5,000 displays each in the months of August, September, and October, and we know that very few were built into cars. According to JL Warren’s tally, Tesla sat on nearly 16,000 screens by year-end.

Shipments wisely stopped in November and December, Ms. Li tells me, but they resumed in January at a rate of 4,500 per month. Result: On March 31, Tesla warehoused more than 21,000 screens. This did not dampen Tesla’s appetite for more screens. “Our checks suggest that Tesla has ordered 5K, 7.5K and 10K central display screens for Model 3 for April, May and June, respectively,” Ms. Li told its paying clients.

“Therefore,” summarizes Ms. Li, “the total supply of screens for assembly would be ~44K (22.5K Q2 production + 21K inventory), and if all being assembly, Model 3 weekly production will be ~3.4K per week.”

Does this mean that Tesla will make 41,000 Model 3 this quarter? Not exactly. First of, Tesla may have exuberantly contracted for a certain monthly supply of screens, and the Chinese supplier simply is fulfilling its contract, come hell or not quite high production ramp. Secondly, there are persistent reports of problems with the screen. A less than just-in-time parts flow would result in a piling up of unusable screens, long before the error has been found. What’s more, once the error has been found, shipped and ordered parts could simply be replacements of failed parts, and we are back to the vagaries on VIN counting.